IP Transactions Best Benefits Overview Services

IP transactions Best Benefits Overview Services

Introduction: Understanding the Strategic Value of Intellectual Property (IP)

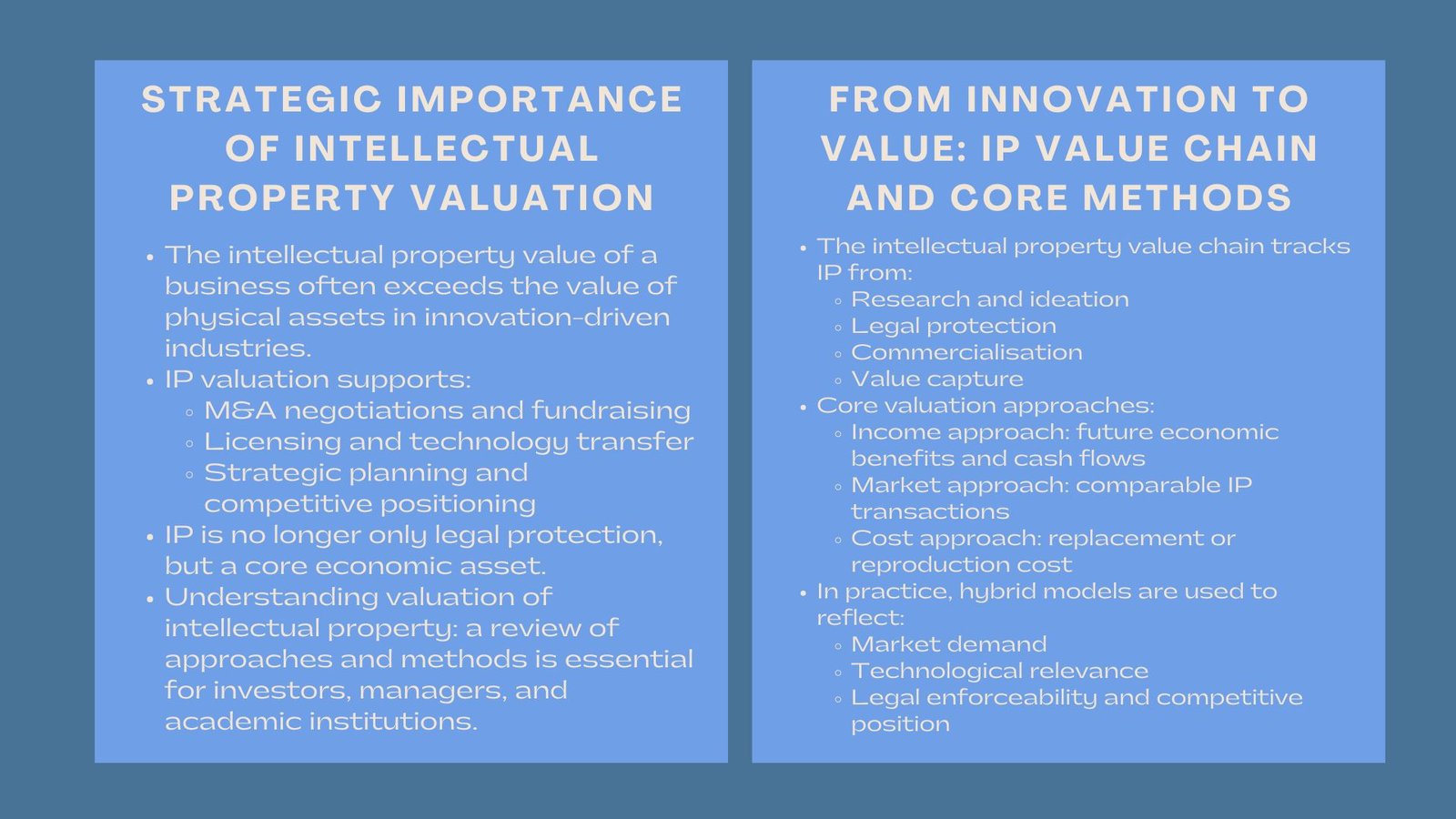

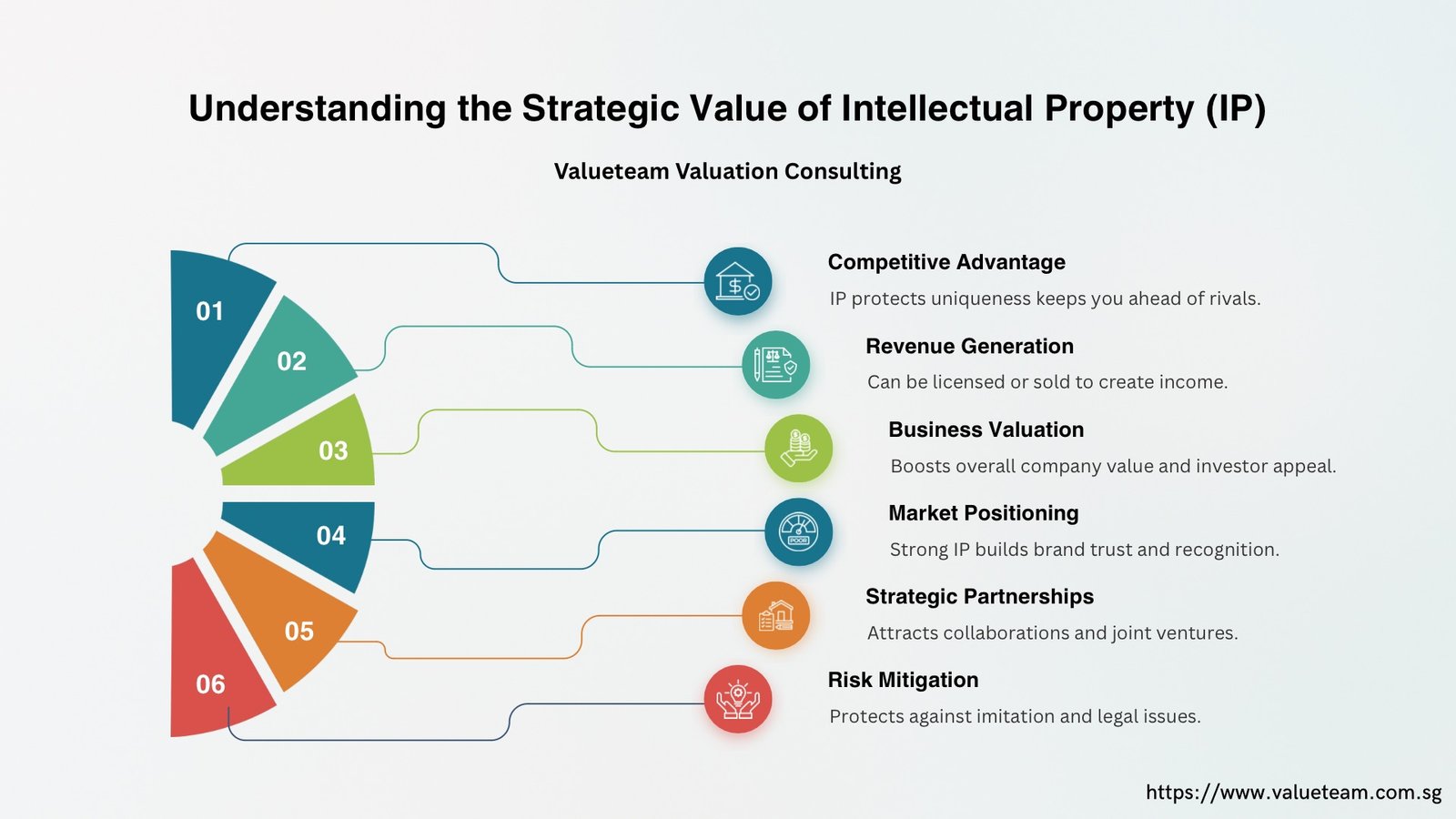

The modern economy has seen intellectual property being converted into a business tool in lieu of protection. It can either be proprietary software, brand names, designs or trade secrets, IP is innovation, market and long term revenue. The result of this has been to make the IP transactions sit on the core of most business strategies, especially in the technological phases, pharmaceuticals, media and consumer commodity sectors.

The expert advisory services designed to help businesses to navigate the complexity of such deals are IP transaction services. These services are critical in ensuring that the companies do not stay in compliance, but they also achieve the best they can get through their intellectual assets.

What Are IP Transactions Best Benefits Services?

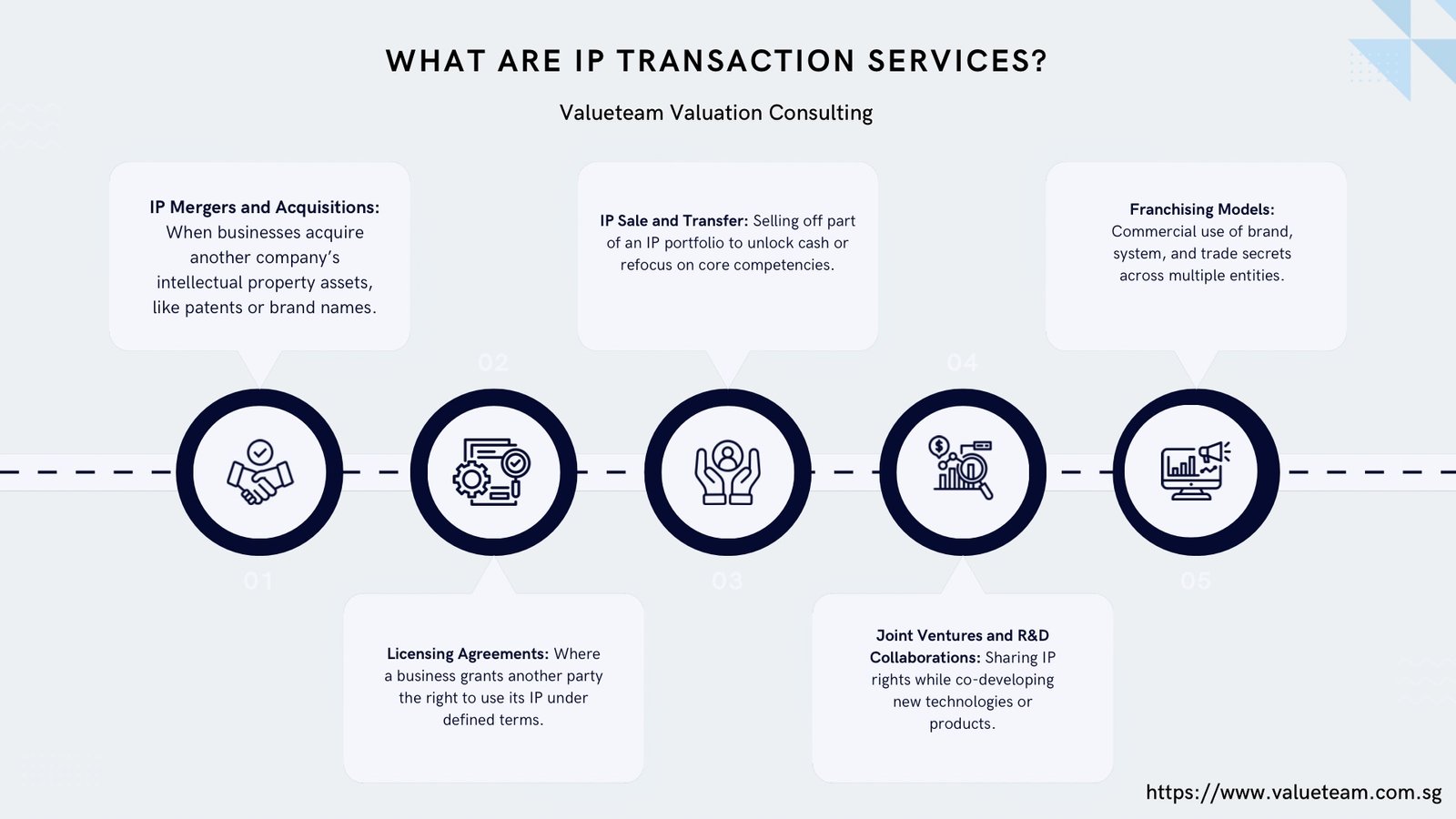

The services of the professional support and expertise in the negotiations, structuring, transaction, and post-deal integration of the intellectual property transactions are referred to as the IP transaction services. These are dealings that can be of:

- IP Mergers and Acquisitions valuation Singapore: This can be defined as dealing with the intellectual property of another company i.e. buying patents or brand name of another company.

- Licensing Agreements: These are the cases where one business provides the right to another to utilise its IP.

- IP Sale and Transfer: The IP portfolio selling is done to get access to the cash or to focus on the core competencies.

- Joint Ventures and R&D Collaborations: The IP rights and the new technologies or products are developed by the same means.

- Franchising Models: A division of business consisting of more than one party of a brand, a system, a trade secret.

These kinds of transactions are normally legal, financial and strategic matters that are complex and RAS involves the need of experienced IP transaction services to come out successfully.

Core Components of IP Transaction Services

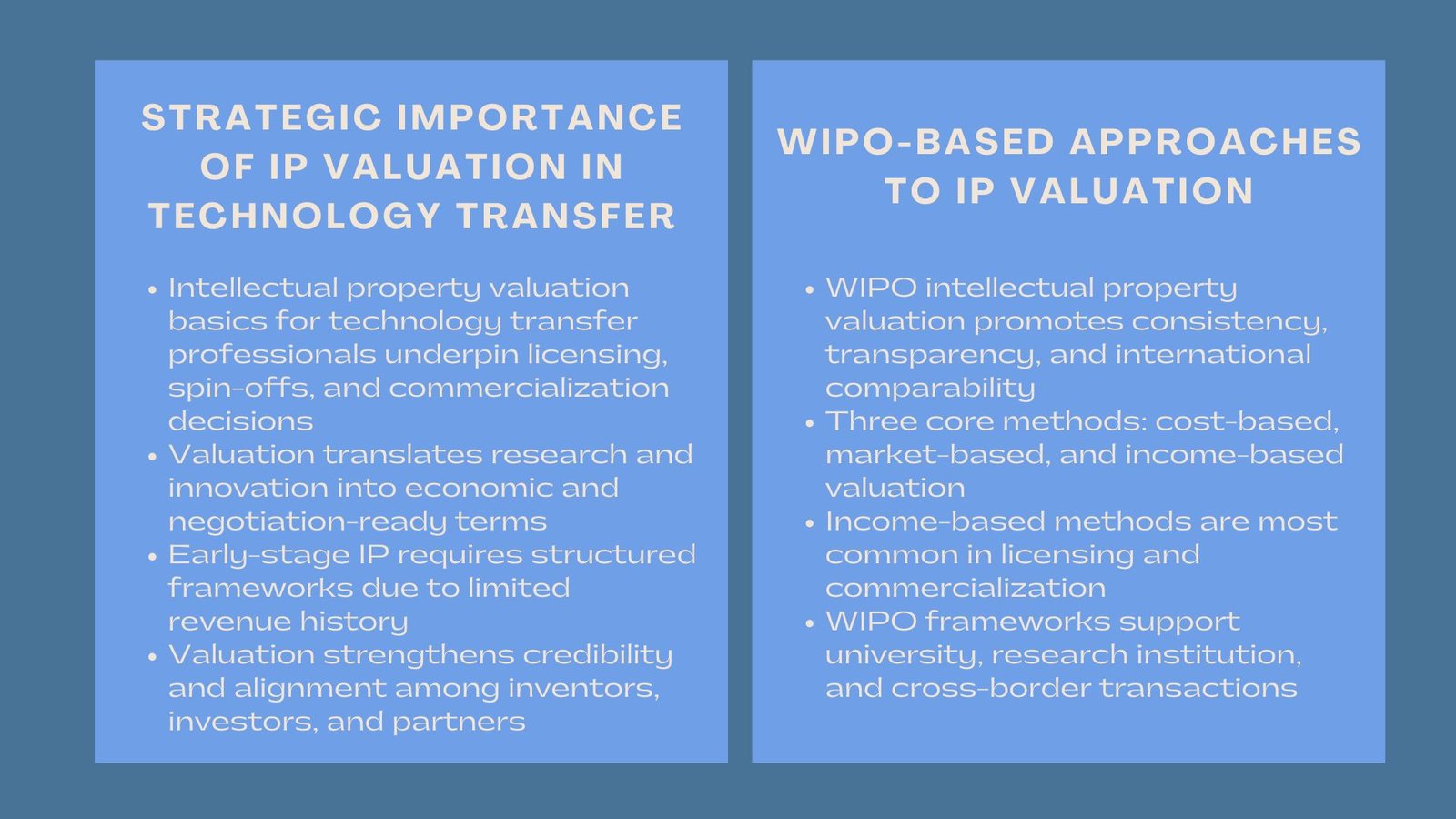

IP Valuation

It is very important to get to know what the fair market value of your IP is. The valuation assists in making sure that your IP is not undervalued or overpriced whether to be offered in sale or valuation may act to aid in your internal planning, valuation, and dispute resolution.

Methods often include:

Income-based (the expected future cash flows)

Market-based (comparing comparable transactions)

Cost-based (how much that would cost to recreate the IP)

Legal Due Diligence

Legal departments consider the IP portfolio in order to:

Make sure the ownership and registration is established.

Determine encumbrances, liens, and forces which occur.

Assess the licensing agreements and renewal.

Documentation with Clean IP is quicker in making a transaction and reduces deal risk.

Tax and Structuring Advisory.

The purchases that are carried out with IP are usually subject to tax. A strong advisory team will:

Recommend best jurisdictions on IP ownership.

Structure transactions are made in response to tax benefits or to prevent non-deductible taxation.

Put into consideration cross-border IP transfer implications particularly in high-IP regimes such as Singapore, Ireland or U.S.

Negotiation and Entitlement of Agreements.

Experts assist in preparing airtight licensing, transfer, or acquisition agreements which run into business objectives without infringing on the rights of an intellectual property. Terms of exclusivity, term, royalties, sublicensing and method of resolution of dispute are crucial.

Support in Regulations and Compliance.

Other jurisdictions or industries mandate the filing or other regulatory securities on transfer of IP, especially with technology, pharmaceuticals or data-based IP. Advisors make sure not to miss compliance with the rules of data privacy, export, or antitrust.

Why Businesses Use IP Transaction Services

Maximize Value: Organize deals which represent the strategic value of your IP.

Minimize Legal Risk: Prevent the litigation and conflict at the beginning of the process and clear ownership, usage and protection terms.

Make Things Grow: Diversify by entering new markets, products or even partners without worrying that your IP assets may be exploited.

Secure Brand Equity: When engaging in a licensing transaction or joint venture, your brand and Intellectual Property Rights are at stake. The use of appropriate transaction terms makes sure that they are utilized in the right way and in the same manner.

Use Case Scenarios: Real-World Applications of IP Transaction Services

Artificial Intelligence to Enterprise Tech startup licensing.

A Singapore based AI startup sells its computer core to an international financial service company. The IP transactions services also cover the restrictions of the agreement to defined sectors and geographic markets thereby safeguarding the future commercialised business of the startup.

Medical M&A acquisition of an assortment of patents.

One of the mid-size medical firms buys the pre-patented medical equipment. Advisors make valuation, evaluate patent expiry durations and facilitate the acquisition relying on the interests to achieve the maximum tax credits of R&D.

Transfer of Trademark across or across borders.

A consumer brand relocates a trademark valuation methods for IP Valuation of the brand to an Asian Pacific subsidiary. Tax and compliance professionals assist in making sure that there is no leakage of value or regulatory violation in the process of transfer.

Conclusion: Unlock Strategic Growth Through Expert IP Transaction Services

One of the most underrated assets which have not been fully exploited in a company balance sheet of Finance in IP Valuation is the intellectual property. Despite scaling up, expanding into different markets, or getting your innovation to single-handedly provide value, getting your IP transactions straight is certainly key to driving long-term value creation.

Through the services of the specialists in IP transaction services, you secure your business interests, reduce the risks and put your business at a strategic growth level. Both as an entrepreneur or a member of a corporate development, viewing IP as any other sign material will help produce returns on the order of magnitude above expectations, by simplifying and codifying IP structure, strategy and legal precision.