How to Pick a Valuation Method for Your Intellectual Property

Learn How to Pick a Valuation Method for Your Intellectual Property

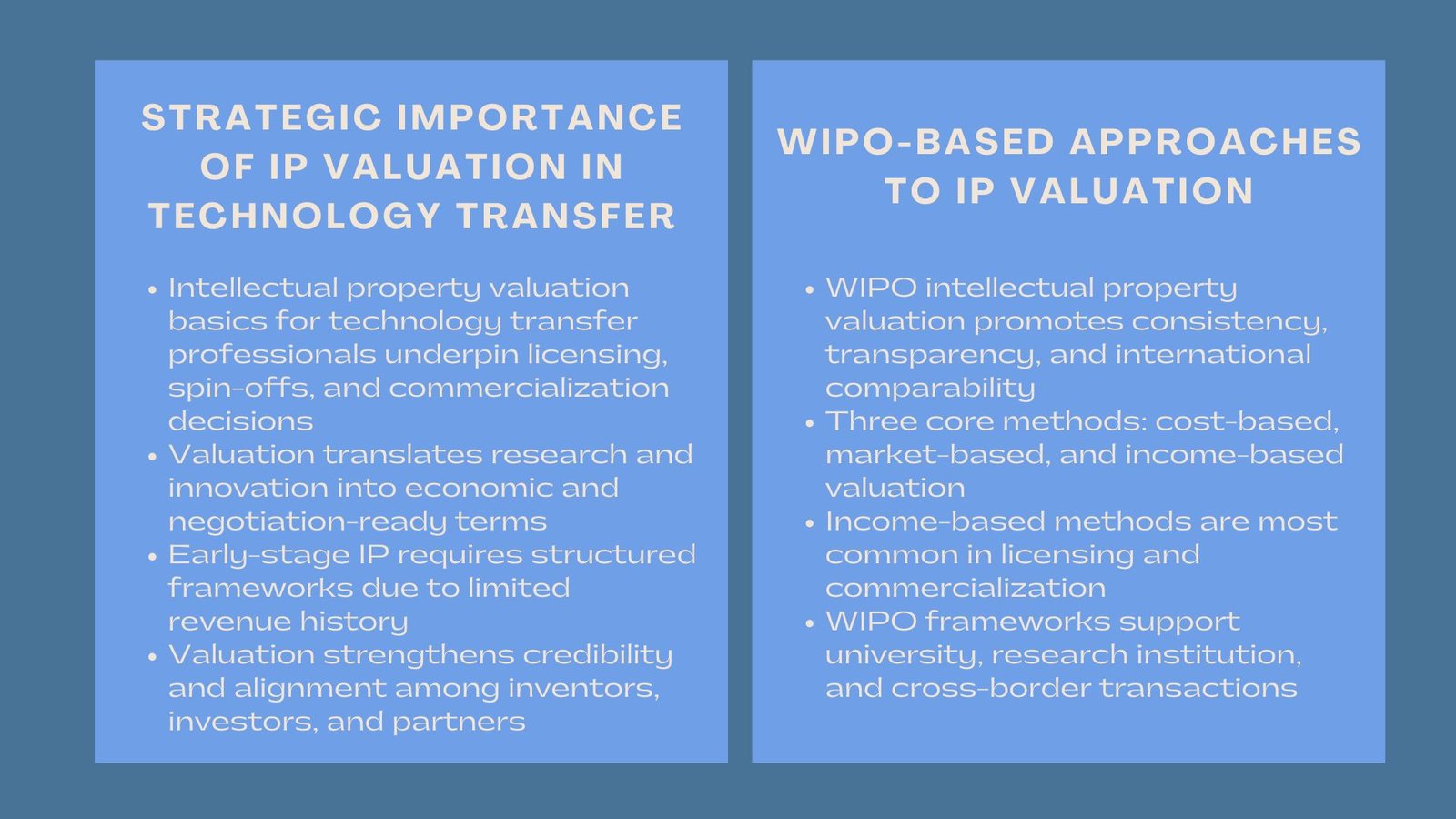

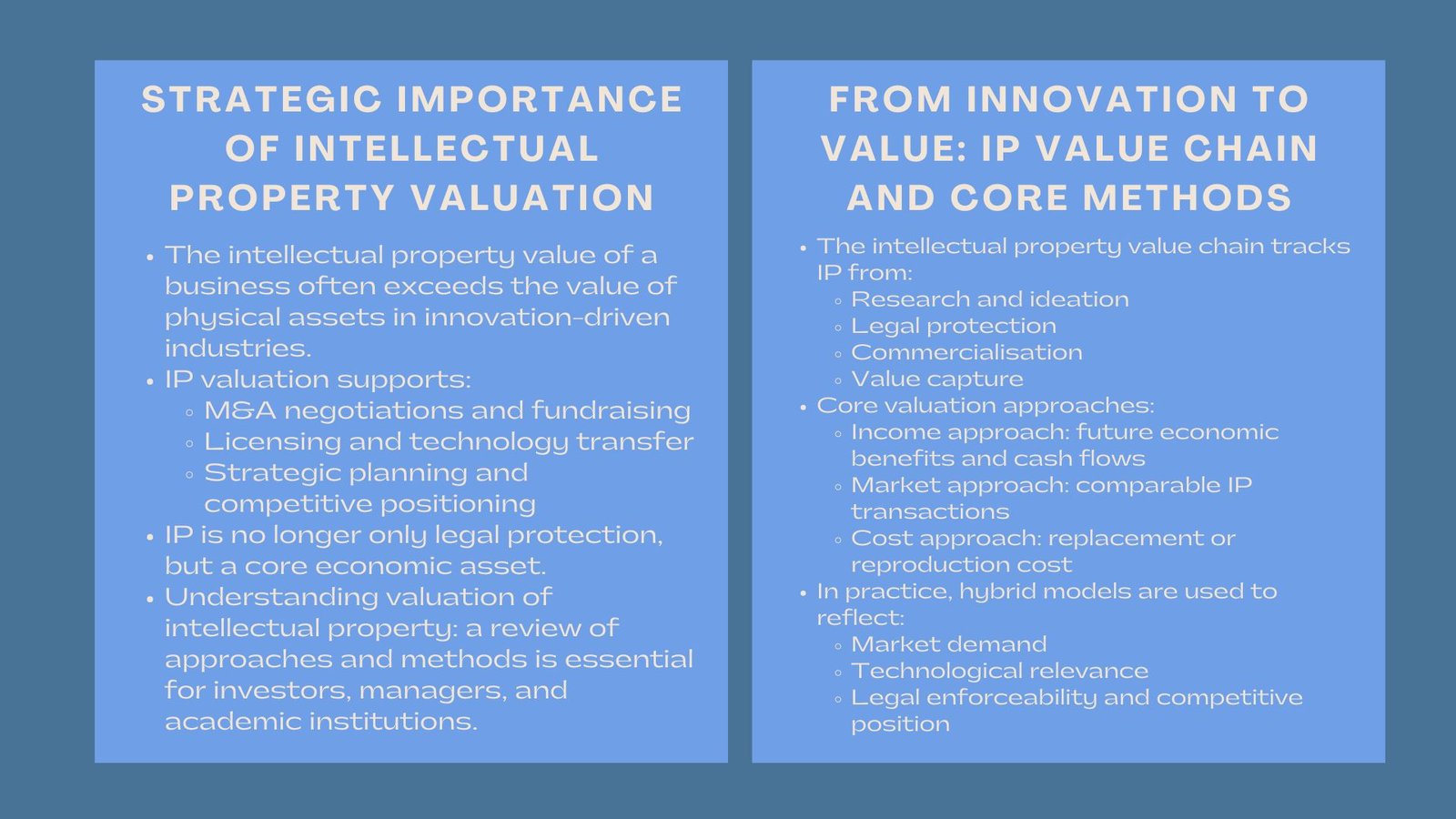

Intellectual property (IP) frequently represents one of the most valuable assets that a business possesses in the modern innovation-based economy. IP can bring about remarkable economic returns that span across a range of proprietary technologies such as patents, brand name, software as well as trade secrets. Determining the value of the IP is the key to unlocking that value, be it in the context of doing business, lawsuits, financing or any other strategic planning. Many companies now rely on patent and intellectual property valuation Singapore experts to ensure accuracy and compliance.

Choosing the right valuation method for your intellectual property is crucial. The approach you take can affect deal negotiations, tax positions, investment attractiveness, and even the outcome of legal disputes. Because IP valuation is both art and science, understanding the available methods and their suitability for different contexts is essential for accurate and defensible results. Engaging Singapore intellectual property valuation services ensures businesses apply the right methodology while aligning with market practices and legal requirements.

Why IP Valuation Matters

The valuation of intellectual property does not just terminate with adherence to financial reporting regulations such as IFRS 3 or ASC 805 in purchase price allocations (PPA) requirements. It guides the decision making in all phases of the life of a company:

- Mergers and acquisitions – On the one hand, buyers and sellers require a flat picture of IP value so that they agree on valid trade.

- Licensing and franchising – value of IP governs royalty prices and licensing prices.

- Financing – Lenders and investors can as well accept IPs to be used as collateral wherein the value of the IPs is well defined.

- Tax planning – Transfer pricing, R&D credits, and amortization deductions that are all based on value defensibility applied in IP.

- Litigation – Where there is infringement or breach of contract, damages are often capable of being measured by reference to IP value.

In the absence of the trustworthy valuation tool business may understate its most prized assets or get involved in the conflict of exaggerated predictions.

Three Main Approaches to IP Valuation

Income, Market, and Cost intellectual property valuations are the umbrella categories under which most of the valuations, although specific techniques may vary are classified. They all have their advantages and disadvantages and the method used often depends on the IP type, the need behind the valuation and on the availability of data.

1. Income Approach

The income approach puts a price on IP in terms of the present value of economic advantages which it is deemed to produce in the future. This is standard practice when IPs give rise to identifiable profits or efficiencies.

The most widely used method in this approach is the discounted cash flow (DCF) method that entails:

- Prediction of cash flows that are related to the IP in the useful life of the IP.

- Estimation of a suitable discount rate that would incorporate risk and time value of money.

- To find the present value of the cash flows which are projected.

Differences exist as there is a relief-from-royalty approach that is used where a prediction is made on how much would be spent to license out the IP to a third party and there is an incremental cash flow approach where the incremental benefit of obtaining the IP rather than failing to obtain the IP is calculated.

When to use it:

- The IP only produces direct, measurable revenues or money savings.

- There are old records or firm projections.

- You require a fair price in money transactions or in financial reporting.

Advantages:

- Curtails the economics of the asset in terms of income generation capacity.

- Vulnerable and generic to a diverse number of IP.

Limitations:

- Depends on correct predictability which is not easy to figure out on fledgling or unstable assets.

2. Market Approach

The market method depends on the IP value corresponding to the value of other assets of this nature that have been sold, licensed, or otherwise sold in the marketplace. The process is conceptually easy-in case a similar trademark or patent sold at a particular price, the asset belonging to you may fetch a similar value.

The analysis of a comparative transaction is not always easy because of differences in confidentiality and individuality of IP assets. With the presence of certain reliable comparables, it is a method that can prove quite compelling during negotiations and litigation, as it is based on the behavior occurring in the market.

When to use it:

- There are similar market transactions that are relevant.

- In your industry, it is a widely licensed or sold IP.

- Comparability is well established in terms of transactions when there is clarity.

Advantages:

- It is market-based, which is intuitive to stakeholders.

- Better not reliant on long term forecasting.

Limitations:

- Constrained by accessibility of acquirable, extensive market statistics.

- The ability to compare and contrast is not easy with unique IP assets.

3. Cost Approach

The cost method of valuing IP puts into consideration the cost to reproduce or substitute it with economic usefulness which is adjusted in case of obsolescence. The proposed approach looks at the amount that will need to be spent to come up with a similar asset, and not the revenue that the investment could generate.

Two variations are common:

- Reproduction cost – The amount to replicate the same asset.

- Replacement cost – The price of constructing an asset to have a similar utility as per the asset under consideration, which can be another technology or a variation in the procedure of doing things.

When to use it:

- The IP is in its early stages and has no traceable income.

- There are no data on the markets or incomes.

- This valuation is insurance based or at the internal level of budgeting.

Advantages:

- It is beneficial with no information about income or markets.

- It gives a practical base of valuation.

Limitations:

- May underestimate the IP that is capable of earning excellent returns in future.

- Neither of these, competitive advantages, brand awareness.

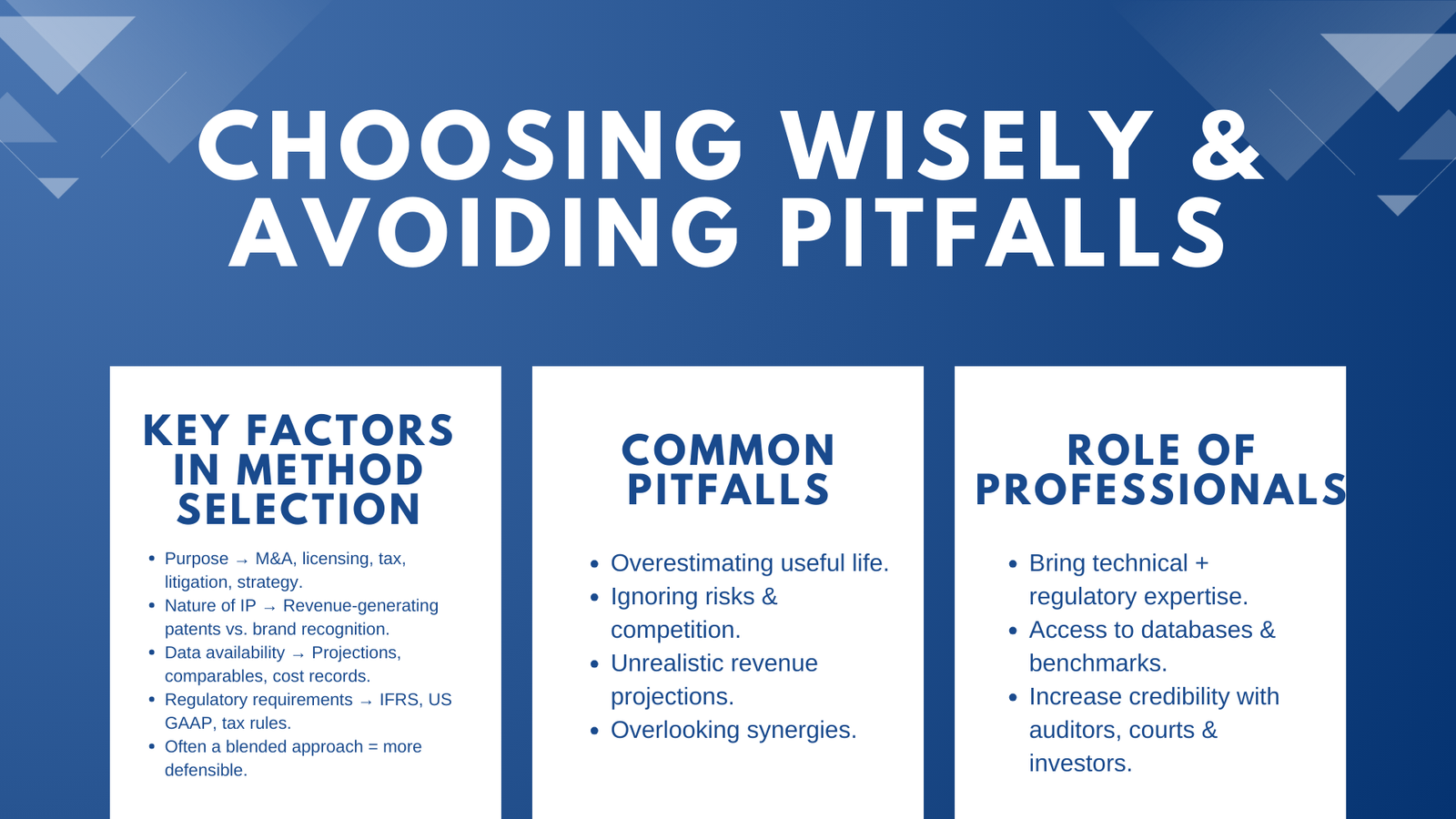

Choosing the Right Method for Your IP

Selecting a valuation method involves more than picking the easiest or most familiar option. You need to consider:

- Purpose of the valuation – Use of Valuation Purpose of the valuation? This is related to the fact that the reason behind the valuation determines how it is carried out. Purpose of the valuation can be M&A, litigation, licensing, tax compliance and internal strategy. Various contexts can have various degrees of precision and defensibility.

- Nature of the IP – A patent that has a well-defined revenue stream may prove appropriate to apply the income approach but a unique business with good market recognition may be appropriate to apply the combination of market and income approach.

- Data availability – Estimated projections, similar transactions, and cost records dictate which approach can be done.

- Regulatory requirements – Preference methodologies may be determined by financial reporting standards or the tax rules.

In a good number of instances, valuers apply more methods of verification of results. Income approach can be accompanied by market approach in the way that the valuation can be helped to be in accordance with the market trends that can be observed.

Common Pitfalls in IP Valuation

IP valuations may be executed incorrectly even when proper technique is applied in cases where assumptions are faulty. The common mistake were:

- Overestimating useful life – It is tempting to think that a patent or a brand will always stay valuable, but this idea can increase valuations.

- Ignoring market risks – The risks that threaten the income stream in the future are disruptive risks, competition and changes in regulation.

- Relying on unrealistic projections – Revenue estimates determined by high income potentials may put income near outcomes beyond what is reasonable.

- Overlooking synergies – Synergies can increase the value of IP and the value of IP may be greater in the possession of a specific buyer than it would have as an independent asset.

The way to avoid these pitfalls is to have valuation done by a very experienced professional who is aware of the technical and commercial nature of IP. The assumptions should be supported by market research and past performance and scenarios that can be used.

The Role of Professional Valuers

Although there are attempts to privilege IP valuation inhouse, in most high stakes matters, professional valuation experts are put to test. Qualified valuers-deliver

- The understanding of the corresponding accounting and taxation regulations.

- Access and use research services trade and trade databases.

- In practice, attention to valuation methodologies application and defense either during negotiations or audit or in court.

Professional valuations also increase the reliability to the investors, auditors, taxing authorities and counterparties in dealings.

Conclusion: How to Pick a Valuation Method for Your Intellectual Property

It is not only about going through the calculations, but it is also about the right direction in valuing the intellectual property. There are also peculiar advantages and disadvantages of each of these instruments: income, market, and cost. In most situations, the most dependable, defendable estimate can be made using a blended methodology.

The answer is to match the valuation technique to the intention of the exercise, the nature of the IP and the accessibility of the good quality data. In such a way, businesses may achieve the maximum potential of the intangible assets so that to enhance their strategic positions and to make more informed decisions in the competitive and an innovation-driven business environment.

In a time when intellectual property can be a make or break consideration of a company strength and value in the market, the ability to choose the right valuation method is not negotiable, but part of the arsenal of sustaining and creating value in a business.