Simple amazing Why IP Valuation Business Singapore Needs

simple amazing Why IP Valuation Business Singapore Needs

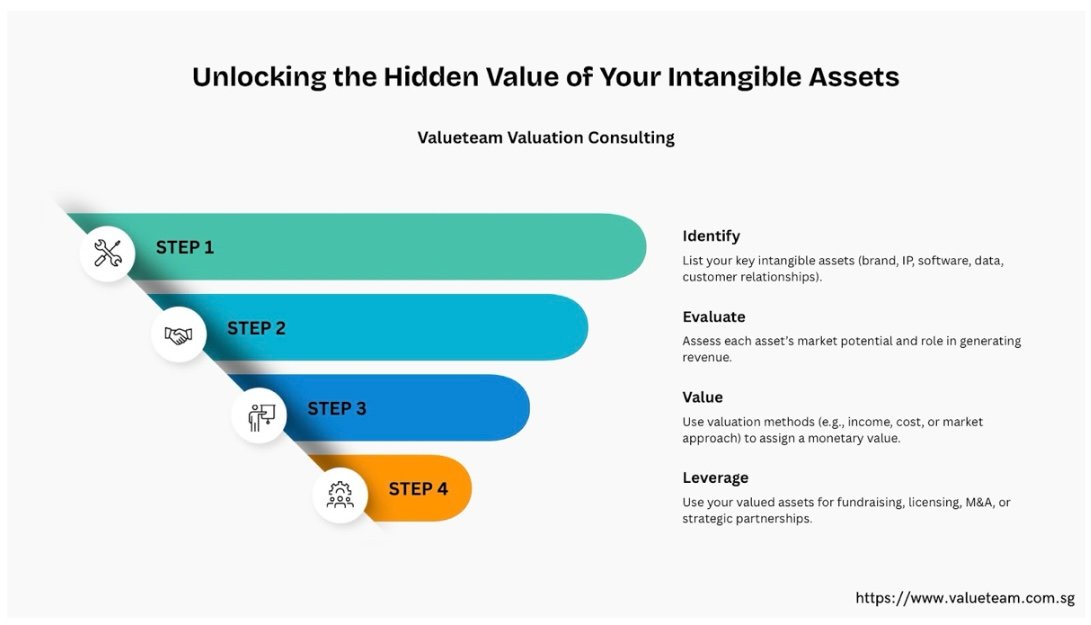

Introduction: Unlocking the Hidden Value of Your Intangible Assets

Whereas in the world of innovation-driven economy, some of the greatest assets of a business today might be invisible. Intellectual property (IP) patents, proprietary technology, tradeller, brand name, software or trade secret may be of more financial value than actual equipment or inventory. In the case of startups, technical companies and creative businesses in general, IP can be the source of long-range development and investment of interest. However, what all companies fail to realize is the fact that they should know the real worth of their IP.

What makes IP valuation a potent financial prism is that you can use it to assess and unlock flame so that investors or other entities you are negotiating with can evaluate you in funding rounds, a merger or are just attempting to optimize your tax planning. Control is not merely about compliance, but control. Proper valuation provides support for smarter negotiations and strategic planning, less international financial planning and analysis Singapore and heightened acceptable amongst investors, partners and regulators.

Why IP Valuation Business Singapore Matters for Your Business

1. Better Fundraising and Investor Trust.

Investors want clarity. They do not merely invest what your company does, they invest what it owns. A professionally treasured IP portfolio indicates that you take knowledge of your personal possessions and are willing to make the most of them. This creates a sense of trust that helps your cause in raising capital as well as may enable high valuation.

2. Better M&A Negotiations

In mergers and acquisition valuation Singapore, IP can represent a huge percentage of purchase price in case of mergers and buyouts. Letting it be undervalued You risk underpricing your brand, software, or any other stuff of little substance. Having a valuation means you are able to negotiate with certain numbers and assurance that you are not going to be bargained by a number lower than that, chances of negotiations or fall in price come acquisition due diligence Singapore.

3. Licensing and Commercialization Opportunities

Intentionally to license your technology or intellectual property? Valuation is the basis of transparent licensing undertakings that are fair. And whether you are negotiating royalty rates or looking to find a joint venture, having knowledge of the value of your IP can result in the favorable terms and the preservation of your rights.

4. Fair Financial Reporting.

In this case, the accounting standards (such as the IFRS) dictate that intangible assets have to be fair valued in particular cases such as the moment of acquisition or internal reorganization of a company. Qualified IP valuation will level your balance statement with real values of assets and meet the audit and disclosure standards.

5. Tax Planning and Transfer Pricing.

IP can readily be moved between companies in cross-border businesses owned by the same entity. Marking up is required to endorse arm length pricing to prevent a problem of tax disputes. It is also useful in unlocking tax benefits like incentives in R&D or deductions in amortizing acquired IP.

6. This encompasses litigation and IP Protection

A reasonable valuation in court is a strong defense in legal litigation such as infringement of IP rights or violation of licensing rights. It is also useful in estimating the losses or the lost revenues caused by the illegal use of your intellectual assets.

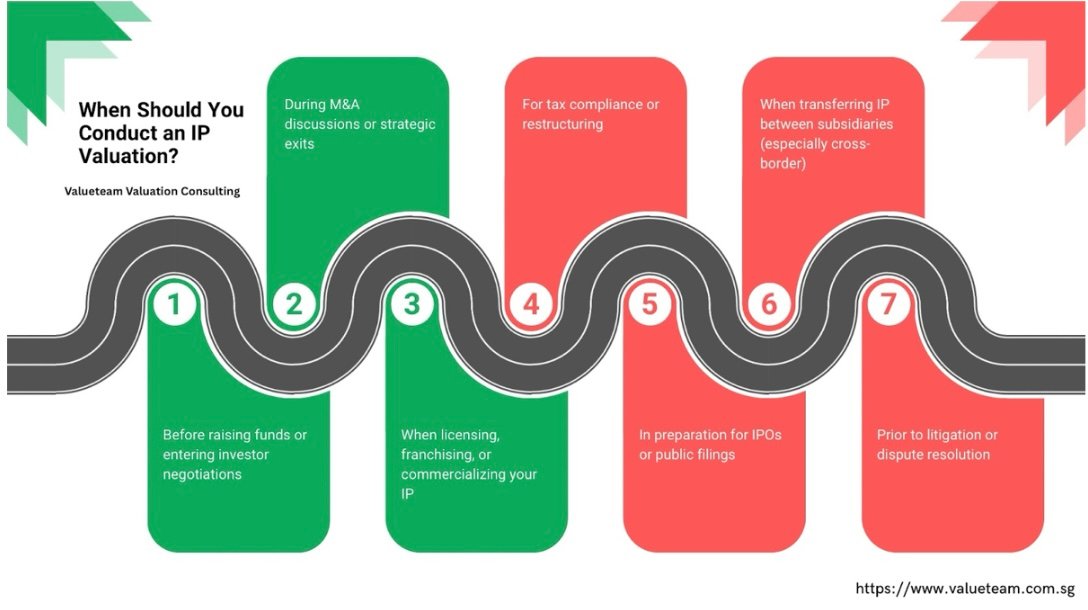

When Should You Conduct an IP Valuation?

Before fund raising or investor negotiations

During the M&A discussions or strategic exits

When Licensing, Franchising or Commercialising your IP

For complying with tax or restructuring

In preparation for IPOs or going public

When transferring IP between subsidiaries (cross-border, in particular)

Before litigation and requiring to resolve dispute

Being proactive means that you can confidently seize opportunities, whereas reactive valuation may create a lack of flexibility and may even open a time for challenges in auditors, investors or regulators.

Common IP Assets Valuation That Should Be Valued

Patents – in respect of inventions, designs or technologies

Proprietary names, brand names, names of products – Trademarks

Copyrights – creative works, software, written material

Trade Secrets – proprietary processes, formula, customer data

Software & Databases – especially internal software or licensed software

Domain Names – especially if associated with strong digital brand presence

Each of these requires a particular approach – usually through cost-based, market-based or income-based valuation techniques dependent upon the nature of the asset as well as the purpose of the valuation.

Conclusion: Turning Intangible Value into Strategic Advantage

An IP valuation is much more than an item on your accounting file – it’s a strategic transformation to grow, protect and monetize your most important business assets. Whether you’re getting ready for a sale, protecting your IP rights or maximizing the interest of investors, it’s crucial to have a real idea of the value of your intangible assets.

By working with people who have extensive experience in the valuation process and when integrating IP insights into your overall financial planning, you will help your company make better decisions, build better relationships, and ultimately unlock more value in your enterprise. Don’t wait to be audited by a transaction or tax auditor to find out what your IP is worth – take charge of that knowledge and try to leverage it to your future.