best Impact How IP Valuation Supports Licensing, Sales, and Partnerships

best impact How IP Valuation Supports Singapore Licensing, Sales, and Partnerships

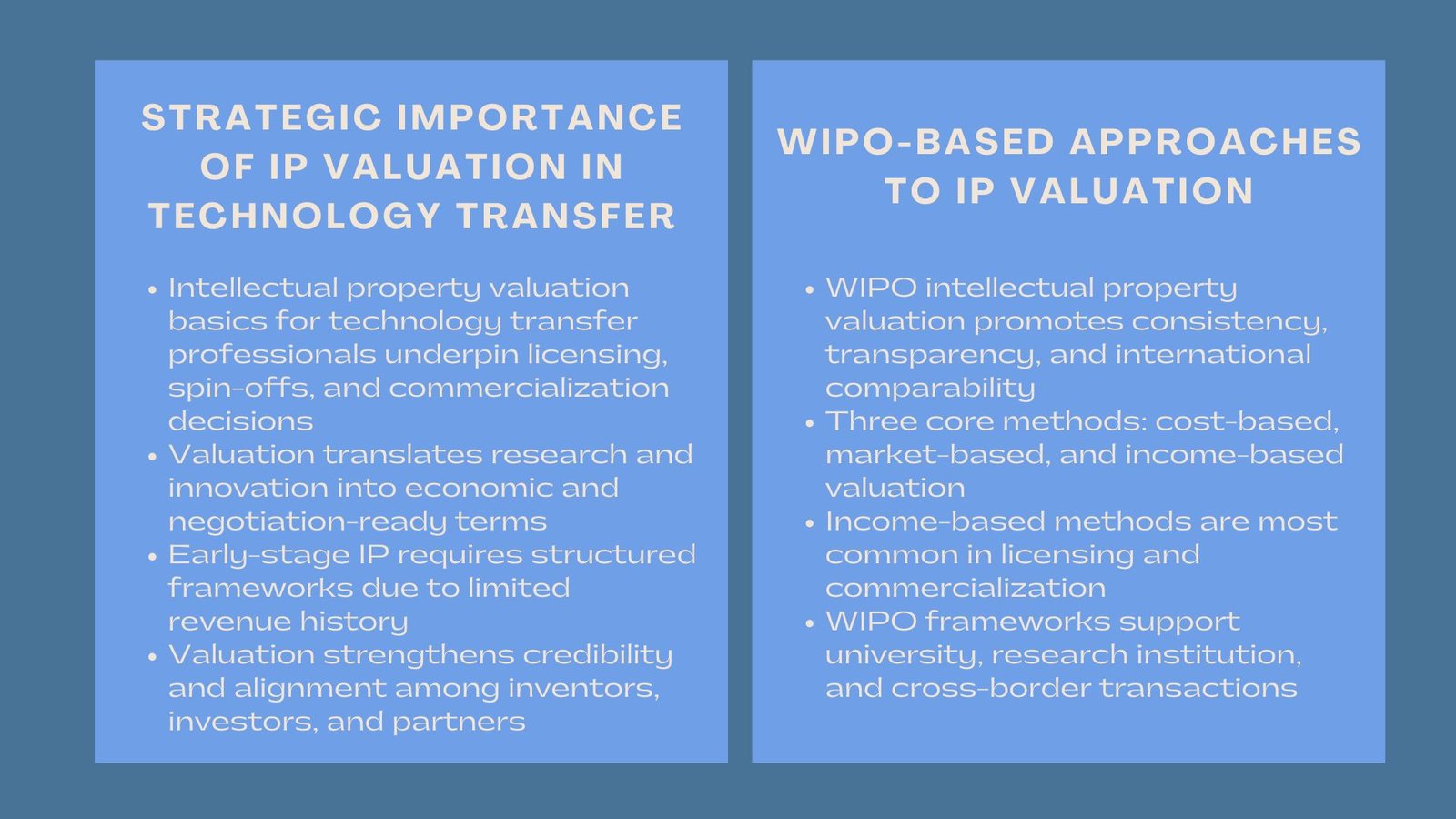

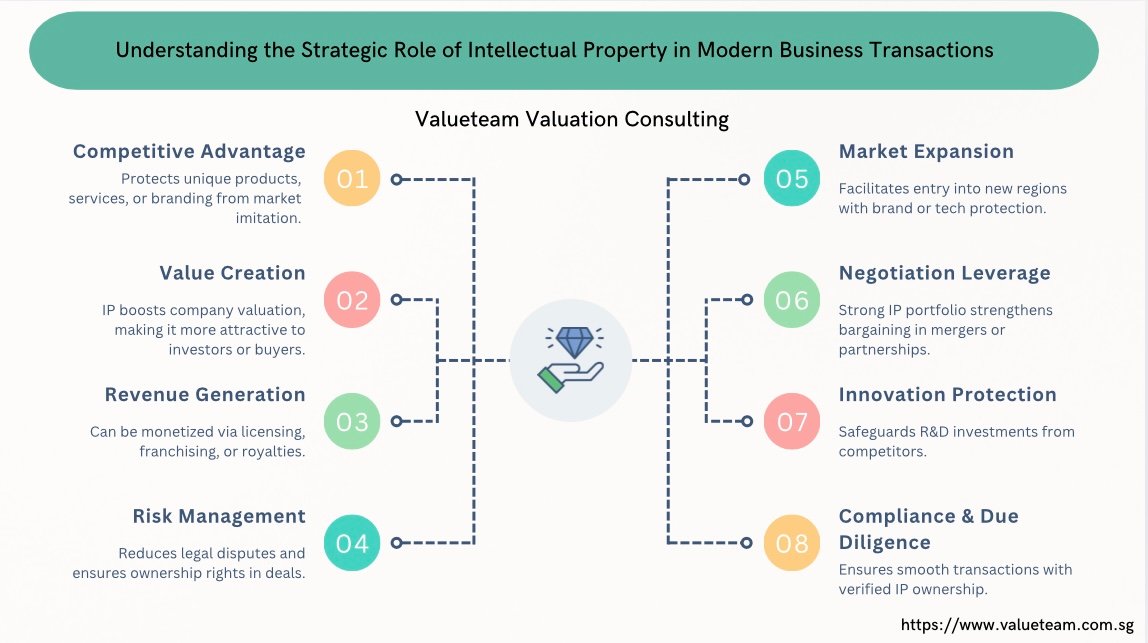

Introduction: Understanding the Strategic Role of Intellectual Property in Modern Business Transactions

In the modern, innovation-driven economy intellectual property (IP) is not merely one of the legal assets, it is a strategic tool. Apple might need to license its technology, sell usage of proprietary instruments, or top-tier an industrial relationship, the worth of your IP can determine the conditions, the delivery of trust, and the course of the transaction. It is no longer optional to have a clear picture of what your intellectual property is worth, whether in the case of startups or even in the established enterprise scenario.

Properly applied IP valuation enables both parties to a transaction make the right decision. It provides standards, gives clarity of negotiation and protects future stream of revenues. More to the point, it can assist in not overvaluing or promising something that might turn out to play a key role in the development of the company. Whether it be software algorithms and patents/valuation of trademark Singapore , brand equity, you must produce numbers that not only make sense but they have to factor through due diligence.

How IP Valuation Supports Singapore Licensing, Sales, and Partnerships

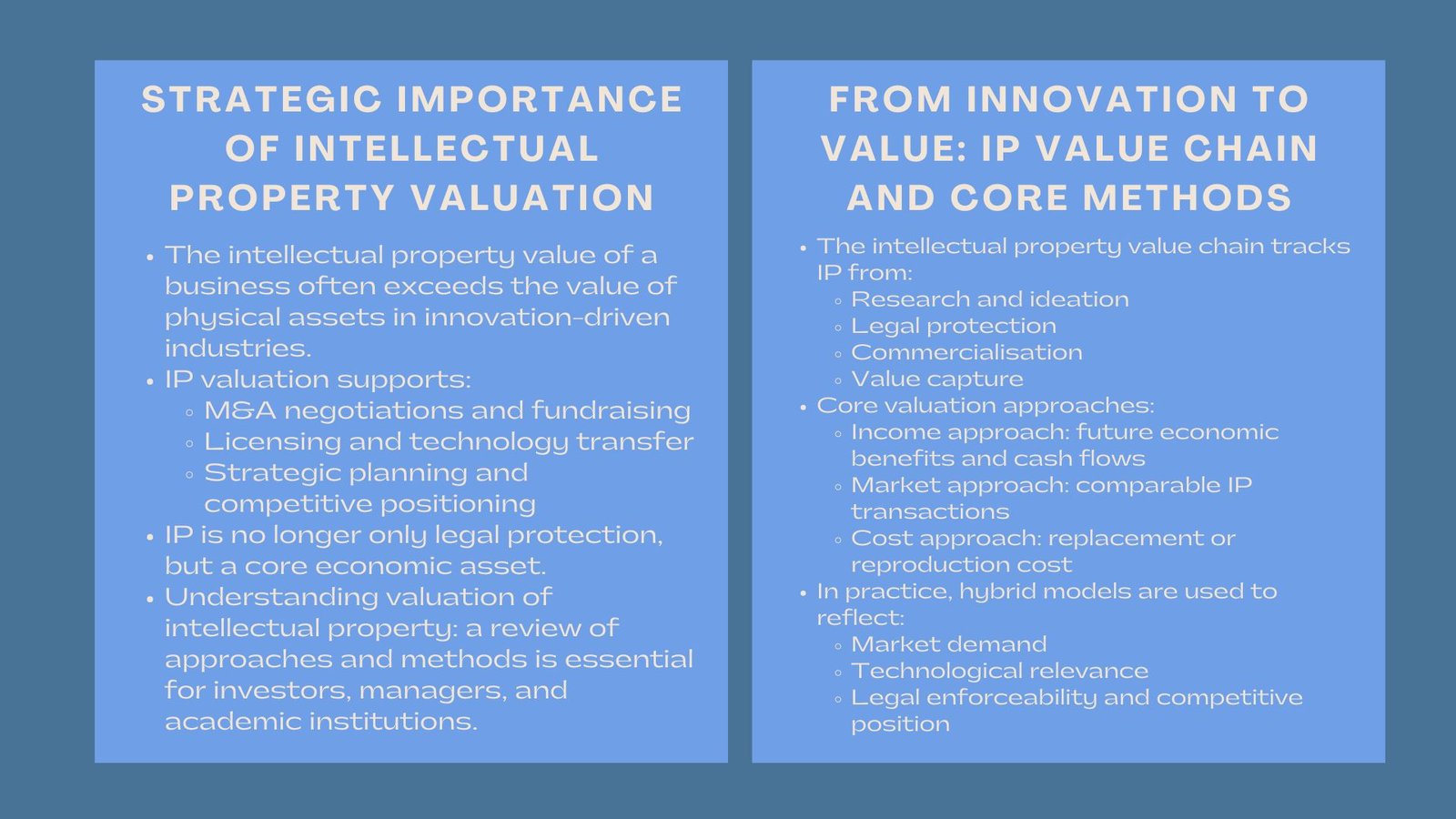

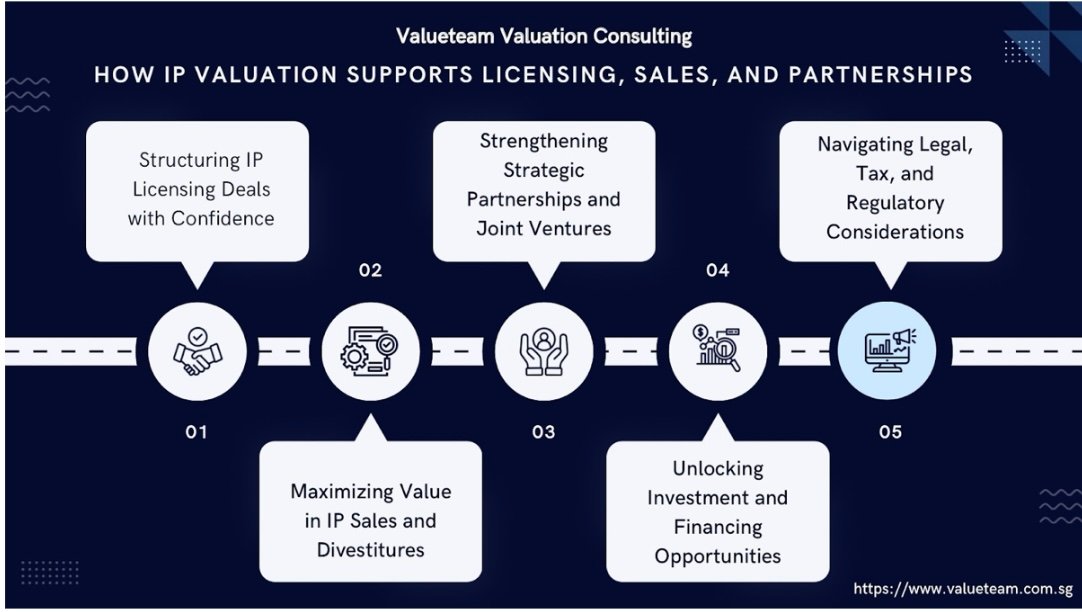

1.Building IP Licensing Deals with Certainty.Companies that would like to commercialize their IP without giving up ownership distinction licensing powerfully. But what do you charge to get access to a software platform, proprietary process or proprietary content?

In that, a valuation of strong IP comes in. It offers a justifiable financial modeling in IP Valuation Supports which concerns earnings projections, equivalent licensing programs and issues in the sector. Not only does this provide license and licensor a clear picture of what to charge but it also creates some element of confidence in the licensee and should a licensee opt to enter into a multi-year agreement or in a cross-border agreement. Credible valuation also defines the limits on the license (e.g. exclusive/non exclusive, regionally/global) and is useful to make prediction on royalty revenues in the future.

2. Value maximisation on IP Sales and Divestitures.

When it comes to selling a patent portfolio, divesting an internal innovation or transferring IP to another party (e.g. restructuring), then valuation proves vital in determining price expectations and regulatory considerations.

Indicatively, in situations of transfer of assets among related parties or subsidiaries in various tax jurisdictions, the IP should be valued at arm length. A professional IP valuation assists in preparing accounting to defend against audit exposures and minimize the probability of incurring a tax liability under transfer pricing tax regulations. To the buyers it will guarantee that they are getting a fair price of a defensible asset that would pay back the investment.

3. Existing Strategic Partnerships and Joint Ventures

The building of many partnerships is based on the cooperative access to technology or joint innovations. However, to work together effectively, one party should almost always know the contribution that IP makes to the table.

IP valuation makes the matters of contribution equity clearer whether one is establishing joint venture or strategic alliance, or even R and D cooperation. It enables both sides to gauge risks and proceeds equitably which is critical towards figuring out agreements such as good-share-bad-share, rights of ownership of the IP and the provision of an exit process. These are extremely significant in fast-growing industries, such as fintech company IP Valuation, medtech, or AI, where the IP may be the key component of the deal in itself.

4. Opening the door to Investment and Financing.

The question that investor ask is: What is your IP worth? And what is it contributing to your revenue model. To answer this question using objective basis, an IP valuation will be useful.

IP value that is properly documented at an early stage of the fundraising efforts may prove to be more believable in the eyes of VCs and angel investors. In the case of mature companies, there is also the increasing IP-backed financing. IP assets would now be recognized as security by some banks and other lenders – provided they are well backed. The only way to have this capital is through a comprehensive valuation.

5. Finding a way around Legal, Tax and Regulatory issues.

The legal and tax implications on IP transfer should be looked into whether licensing, selling or the initiative of establishing a partnership. A formal IP valuation also enables the contradiction of the reporting requirements regarding the accounting standards such as the IFRS and assuance that they comply with the tax authorities.

It also can help the legal teams to come up with terms reflecting the actual economic worth of the IP. This also involves the warranties, indemnities and licensorship provisions that are dependent on the estimated value of the IP. Valuation is vital as evidence in legal battles such as when an individual violates IP rights or fails to pay royalties.

Conclusion: Know the Value Before You Negotiate

One of the most potentially valuable and ignored resources is your intellectual property in business. Enhancing presence in a licensing deal, soon to be sold or to forge a strategic relationship, then a professional IP valuation will provide you with the foundation, negotiation advantage, and undefended capabilities to make smarter decisions.

You should not do it at some point in the middle of a negotiation, you should not do it when you see regulators looking directly your way. Enlist valuation consultants early so that your IP narrative is not supported by speculations. Under the proper insight, your IP can open up growth and attract partners in addition to extracting value far beyond the deal.