The Role of IP Valuation in Startups and Fundraising

The Role of IP Valuation in Startups and Fundraising

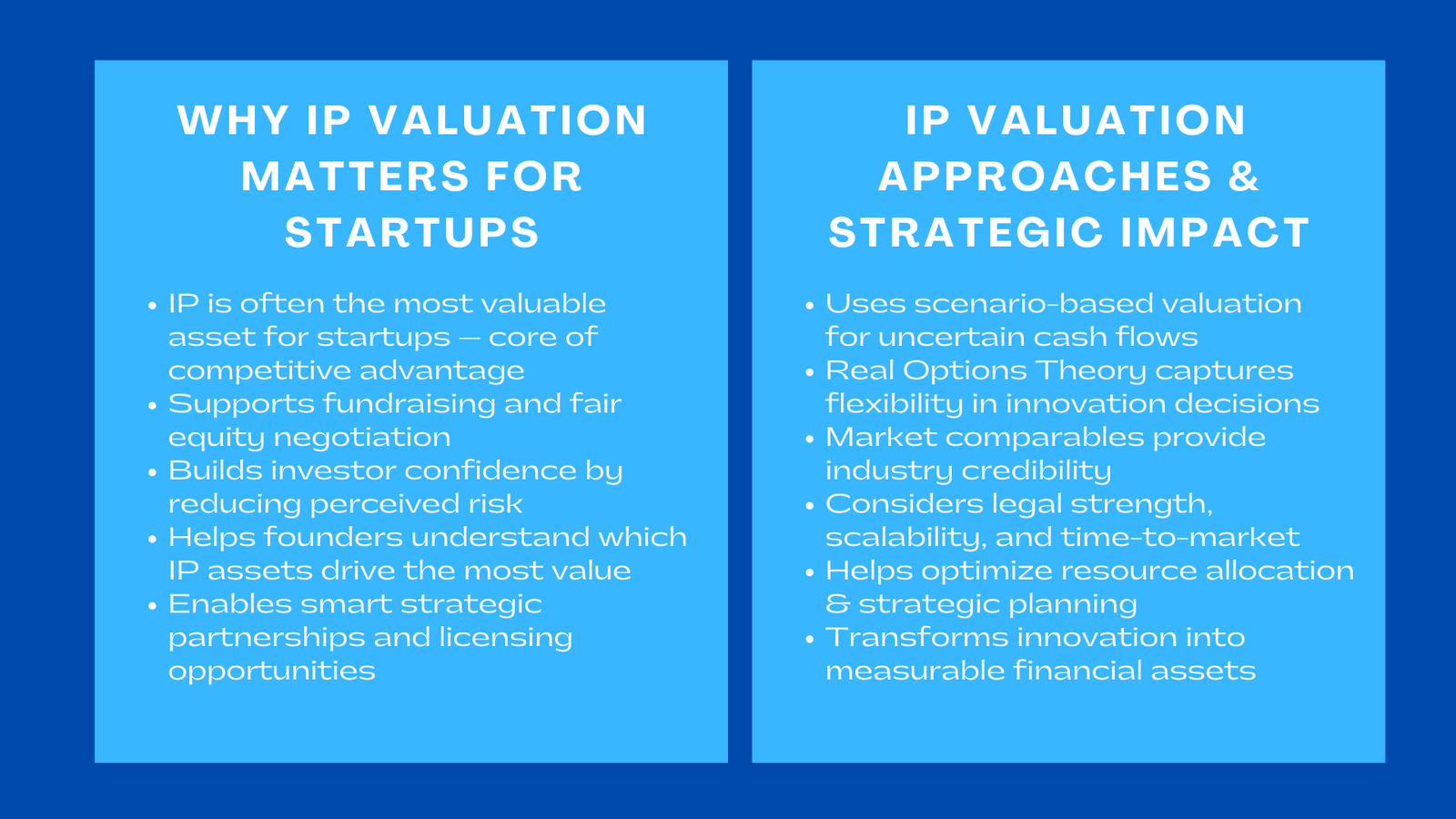

For startups, intellectual property is typically the most valuable – or the only – asset on the balance sheet. Whether it is a proprietary algorithm, design or brand, IP is at the core of competitive differentiation, and what investors want to see. Being able to successfully value it is how startups raise funds and negotiate equity terms, as well as justify pre-revenue valuations.

Other than raising capital, valuing IP gives founders and management teams the clarity that they need strategically. It enables them to determine which assets drive the most value, helps them prioritize development efforts, and makes informed decisions about licensing or partnerships and/or acquisitions. Transparent and supportable valuations also decrease investor uncertainty, and create the confidence in the startup’s growth potential and long-term sustainability, especially when supported by certified IP valuation methods training Singapore that enhances accuracy and credibility.

Ultimately, the interesting Harris is that when company owners earnestly integrate IP valuation into startup governance, the protections that historically may have been viewed as cost-mitigators come to be seen as profit maximizers. By knowing and being able to communicate the financial value of their intellectual property, startups can build stronger relationships with investors, negotiate from a position of power, and provide a strong foundation for growth and success in the market.

Why IP Valuation Matters for Startups

Investor Confidence: Accurate valuation of intangible assets provides evidence of the ability of the asset to grow over time and give investors confidence in the future outlook for a startup. This transparency mitigates the consequence of perceived risk and enhances trust, and consequently, attracting funding would be easier and terms of investment could be favorable.

Equity Negotiation: With a known way of identifying the value of IP-based pre-revenue startup valuation methods, founders can retain their fair ownership in funding rounds. By assigning a dollar value to the proprietary technology, designs, or brand properties of a startup, it can justify its pre-money valuations or valuation and negotiate ownership stakes with confidence rather than letting ownership be harmed through dilution of ownership.

Strategic Partnerships IPs also help with creating strategic partnerships, such as licensing deals or joint ventures. When providers can grasp the tangible value of the intellectual property (IP) created in a startup, it is more likely they will enter into mutually beneficial transactions that will speed the market entry and commercialization of the technology.

M&A Readiness – startups that have a well-documented and defensible IP valuation are in a better position for such acquisitions in the future. Accurate valuation offers clarity regarding the contribution of intangible assets that potential acquirers are willing to pay to convert the assets into cash and can then use to facilitate deal fairness and synergies, as well as enjoying the benefits of a reduced due diligence process.

All in all, IP valuation is an extremely significant tool that is a cornerstone of investor relations, equity management, partnership development and M&A strategy. By systemically analyzing and conveying the value of their intangible assets, startups are able to optimize strategic opportunities, tap into the appropriate capital base, and set up a strong base for ongoing growth and long-term profitability.

Valuation Approaches

Startups often do not have any historical revenue data, so traditional income methods of valuation models become difficult to use. To account for this, analysts create approaches to account for uncertainty in the nature and growth potential of early stage ventures. One general approach is a probability-weighted scenario, where different possible outcomes (from market success to a partial adoption to failure) are given likelihoods. This gives investors and founders a way of estimating the expected value even when there are no stable cash flows, and the opportunity to capture both an upside potential and downside risk.

For businesses that are R&D heavy, option-based valuation, also referred to as the Real Options Theory, is gaining increasing use. This method treats investments in new technology or product development as options, which put a value on the flexibility to pursue, delay or abandon investment projects based on changing market conditions. The Real Options Theory allows capturing strategic importance of decision under uncertainty that takes a more dynamic view than standard discounted cash flow models.

Market comparables are also used in instances where there are similar start-ups or licensing transactions, which provide better benchmarks for valuation based on industry standards, transaction multiples or royalty rates. While comparables may need to be adjusted for size, market scope or technology differentiation, they do provide an external reference point which helps to enhance credibility and investor confidence.

In addition to being valued on a financial basis, risks and opportunities of legal strength, scalability and time-to-market come into play in the valuation framework. These factors have an impact on the risk premium that is placed on projected outcomes, and reflect the likelihood that the IP/business model will reach commercial success. Strong legal protection, high scalability, and quick deployment means less risk, which makes the startup perceived as more valuable, IP valuation in venture capital due diligence while weakness in any one of these, for example, means that a larger discount should be applied to compensate for uncertainty.

By considering a combination of scenario analysis, real options, market comparables and qualitative risk modification, startup valuations are made both defensible and forward-looking. This method offers founders, investors, and strategic contractual partners a sound base for creating well-informed choices, effecting eco-friendly the allocation of assets, and solidifying prolonged enlargement procedures.

Conclusion

In nascent markets, IP valuation is a connection between innovation and capital. It serves as translating technical potential into financial terms that can be measured by the investors, and this helps them to have a good objective judgment about risk. From founders’ sides of the ownership equation, it’s key to making better decisions around IP value for smarter fundraising, sustainable ownership structures, aligning with strategic goals over the long term, and gaining more insights into startup success. In a nutshell, valuation converts ideas to believable financial assets that drive growth.

In addition to fundraising activities, robust IP valuation is an important tool that aids in strategic decision-making. By being able to identify the actual economic value emanating from proprietary technology, designs or processes, startups can better prioritize development strategies, construct timely and effective licensing or partnership agreements, and better prepare for future acquisitions. It also serves as a basis for the negotiation of fair equity splits, attracting co founders, and a basis of aligning incentives for the team with value creation.

Finally, IP valuation can help startups and investors make sense of the uncertainty that is inherent in early stage ventures. The concept is to bridge the gap between creative innovation and financial rigor to help turn intangible ideas into intangible metrics that inform how to invest, plan and ensure sustainable growth. Companies that make IP valuation a core part of governance position themselves for long term success, credibility in the market and competitive advantage against businesses operating in knowledge-limiting and increasing industries.