IP Valuation in Business Combinations under IFRS 3

IP Valuation in Business Combinations under IFRS 3

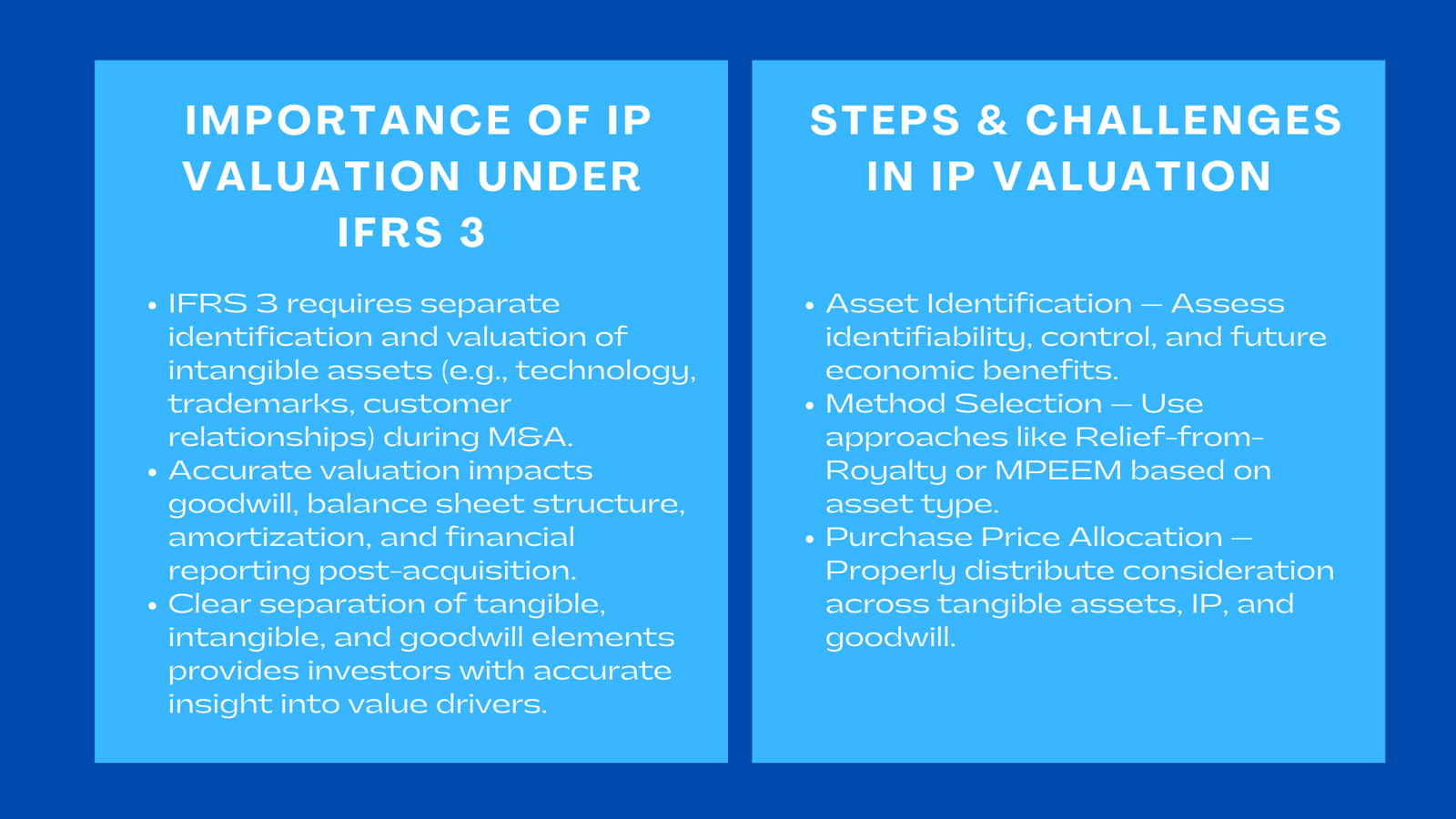

As part of the merger and acquisition process, IFRS 3 requires companies to identify and value all intangible assets separately identifiable in the merger and acquisition transaction – including intangible assets such as IP assets (technology, trademarks, customer relationships etc.). These valuations have a direct impact on goodwill, balance sheet composition and amortization after the purchase.

The correct allocation of the value of IP assets provides the necessary disclosure in the financial statements of their true economic value as part of the business operation, which is not treated as a goodwill and disclosed separately. By understanding and separating out tangible, intangible, and goodwill elements, companies can present stakeholders with more accurate insights on the drivers of acquisition value, facilitate the development of more accurate financial planning, and be more compliant with accounting standards.

The process of identifying and valuing IP assets is an extremely important part of any acquisition and strategic management. It gives companies the ability to monitor their performance of high value assets, drivers, and plan effective resourcing and amortization or impairment testing with confidence. In addition, documentation of methods, assumptions, and valuation creates greater audit readiness and greater investor confidence that the acquisition is most financially transparent, as well as strategically correct.

Ultimately, strict IP valuation in mergers and acquisitions IFRS 3 manages to cover the distance between being accounted for and being valuable. By investing in proper identification and measurement of intangible assets, organizations can improve corporate governance, reduce financial reporting risks, and strike the best deal from mergers and acquisitions in the long-term.

Steps in the Valuation Process

Asset Identification:

The initial step in IP valuation at the time of mergers and acquisitions is determining whether the IP falls under the criteria of identifiability, control and the ability to generate future economic benefits. Identifiable assets are differentiated from the business or are the result of a contract or legal right, whereas the element of control ensures that the buying company has the ability to curb other’s access to the asset. Evaluating future economic benefits where it can be anticipated how contribution of the asset to the revenues, cost saving or strategic advantages can be forecast, this will ensure that only those assets with measurable value are recognised on the balance sheet, an approach often emphasized in comprehensive IFRS IP valuation workshop Singapore programs.

Valuation Selection:

Once the IP has been identified the next step is establishing a suitable valuation methodology. Common approaches would be the Relief-from-Royalty Method for brands and trademarks, which will estimate value on the basis of avoided royalty payments, and the Multi-Period Excess Earnings Method (MPEEM), which would be common for customer relationships or proprietary technology. The selection of methods depends on the nature of the asset, available data and the revenue or cost benefits that it will generate. Proper choice of method is necessary to ensure that the valuation considers market realities as well as accounting standards.

Involvement of Purchase Price:

After pricing every intangible asset, companies must allocate the total purchase consideration to tangible assets, intangible assets, and goodwill. This ensures that the amount of goodwill-written off against those synergies, values of brand, group strength or positioning of brand, etc., amounts to only the value not attributable to trade marks. This allocation impacts post-acquisition amortization, impairment testing and financial ratios suggesting that precision in the valuation and allocation process is important.

Documented and Various Disclosures:

Finally, careful documentation and disclosures are necessary in order to withstand valuations to auditors and regulators. This includes giving detailed models, supporting assumptions and reconciliations to the transaction economics. Comprehensive documentation to show that valuations are reasonable, transparent and will comply with IFRS 3, IAS 38 and IFRS 13. It also makes it possible for stakeholders – investors, auditors and management – to understand the rationale behind that allocation of purchase price which, in the end, provides greater confidence in the integrity of financial reporting and strategic decision-making process.

By ensuring that asset identification is systematically carried out, the right valuation methods are used, the right price is allocated and there is comprehensive documentation, companies can make sure that IP valuation in mergers and acquisitions is both compliant and strategic. This rigorous approach adds to the financial transparency, post-acquisition integration, and maximum value creation over the long term.

Common Pitfalls

Interactive Property Rights Between Purchaser and Seller:

One of the issues related to IP valuation in M&A deals is the existence of overlapping rights among the IP rights of both the acquirer and the target. As the two entities will often have similar patents, trademarks, or technologies, there is a risk of double counting or value overstatement. Detailed analysis will be needed to separate the incremental value added by poor-quality acquired IP to the merged group. This includes considering the exclusive and market coverage as well as the potential synergies, and to ensure that the valuation does not include any economic benefit other than the extra benefit that the acquisition conveys.

Varying Assumptions of Discount Rate

Discount rates are important inputs to income-based approaches to valuation such as the Relief from Royalty or Multi-Period Excess Earnings Method. Assuming incorrect discount rates or different discount rates can cause serious biasing of the present value of the projected cash flows. Analysts are required to meticulously calibrate the discount rates according to the-specific risk profile of the asset, the industry standards and the conditions prevailing in the market. An approach to valuation that is consistent across all components of the valuation cycle should result in reliable, comparable and defensible results for auditors and investors.

Understated Contributory Asset Charges

Contributory asset charges are the returns that are really associated with other assets used in the support of the IP (working capital for example, or fixed assets or other complementary technologies). Failure to account for these charges will overvalue the IP asset representing valid goodwill and total consideration of acquisition. Music estimation requires a deep knowledge of the operating and financial inputs of supporting assets. These charges should be taken into account when preparing the IP valuation to avoid unrealistic results, in accordance with accounting laws, and to ensure the basis for future financial reporting and strategic planning of the acquired company.

So by dealing with overlapping rights, consistent discount rates and the correct use of contributory asset charges should be high on the agenda of actively applying IP valuation to enable credible, defendable, and strategically meaningful values that will survive the scrutiny and enable informed decision making into transactions of mergers and acquisitions.

Conclusion

IP valuation in business combinations is not just about accounting compliance – it reveals intellectual property fair value in acquisitions, the percentage of an acquisition that is really due to innovation. Accurate and defensible valuations prevent companies from being disagreeing with audits, aid in the post-acquisition reporting differences and give transparency to the investors. In an economy where intangibles dominate corporate value, the accuracy of IP valuation is a key element of making sure mergers are both strategically and financially appropriate.

In addition, good IP valuation drives decision-making throughout the acquisition lifecycle. It helps acquirers to determine which assets create the highest economic value, informs the discussions in determining how to allocate the purchase price and guides the strategic integration process after closing. By measuring the value of intellectual property, companies will be able to make informed decisions when it comes to licensing agreements, R&D investment, and operational synergies, as this will help ensure that the value created for the combined entity is as high as possible.

Finally, IP valuation is a link between innovation and financial responsibility. Organisations that do valuations seriously, openly, and with sufficient documentation not only satisfy the accounting but also increase the confidence of investors, reduce the risk after the acquisition, and practically make use of intangible assets to generate sustainable growth and better positioning for the long term.