Accredited Digital Asset Valuation Workshop

Copyrights, Software, and Digital IP Valuation

Learn Accredited Digital Asset Valuation Workshop

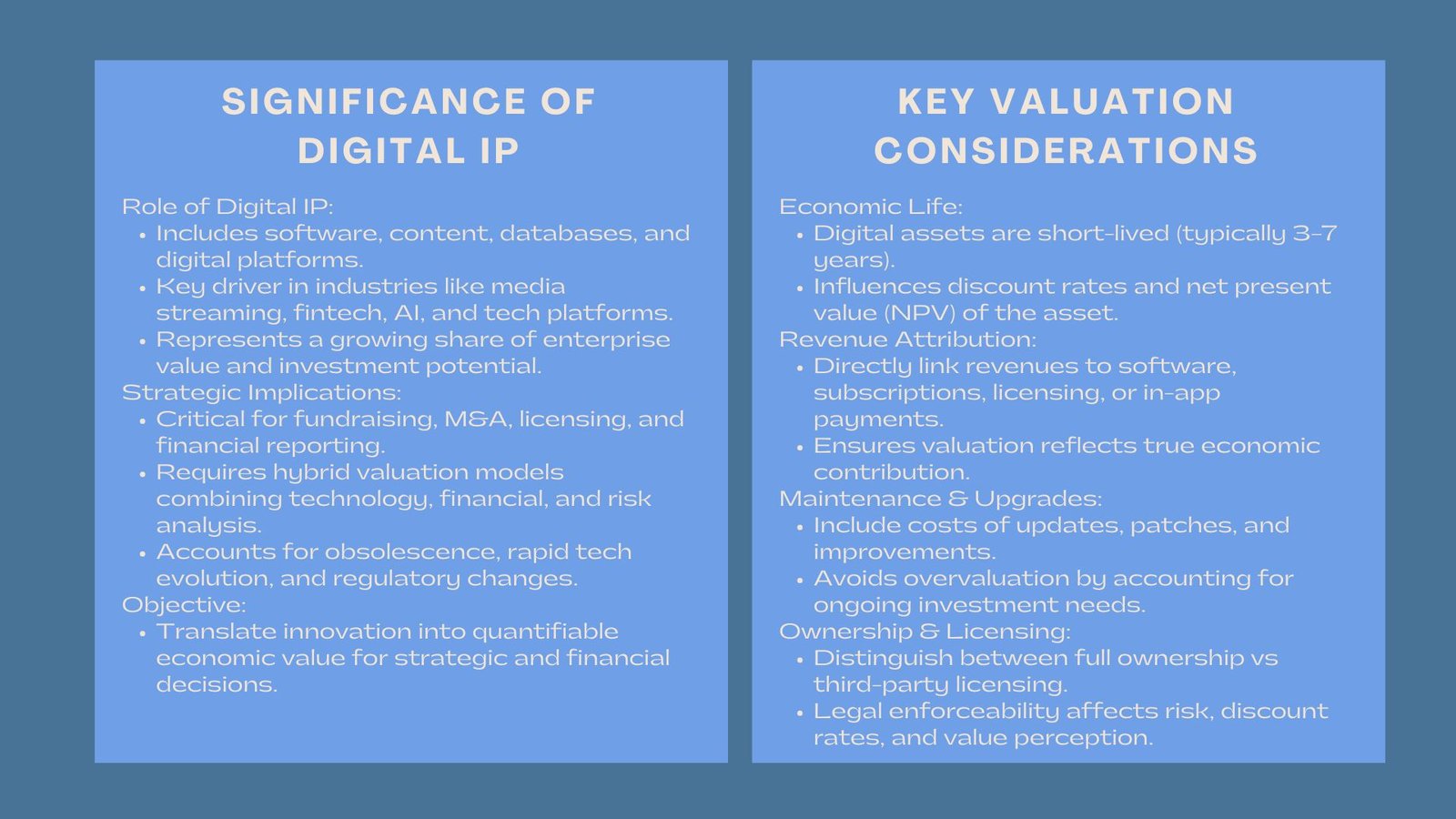

Digitalization of business has opened up intellectual property inclusive of the old patents and trademarks. The new frontier of IP assets that exist today comprises software, content, databases and digital platforms. Media streaming up to fintech and artificial intelligence are some of the industries that grow because of copyrights and proprietary codebases.

Digital IP is also highly valued, and it is necessary to fundraise, M & A, and even report it under IFRS or local GAAP. However, due to the dynamism of the digital assets, the value may need some form of a hybrid model that incorporates both the technology analysis, financial analysis, and the risk analysis.

It is essential that companies with the digital products consider both the cost of development, development history and the potential sources of revenue, scalability as well as lifecycle of digital products. Compared to tangible assets, there is high depreciation or obsolescence of the digital IP as a result of technology development, market destabilization, or new regulations and therefore valuation at the appropriate time and place is important.

Income-based models, proximate in modeling finances of digital IP, can include discounted cash flow (DCF) analysis, which attempts to forecast revenues to be obtained by licensing or subscription, or by embedded use in a product. The cost-based approaches, such as replacement or reproduction cost, can be used in circumstances where the future cash flows are uncertain or where software and content assets are in the preliminary stages of development and thus have no market equivalents. Another tool is market-based benchmarking which makes use of transaction records of similar IP sales or licensing deals to justify valuations and assist in strategic decision making.

In addition to financial measures, an in-depth assessment involves the use of technology and legal factors. Value directly depends on the strength of the codified material, security, patented inventions as well as enforcing copyrights. Also, threats like cybersecurity breach, software piracy, and quick obsolescence should be considered in the digital IP valuation. Combining these developments is the way to have a realistic evaluation that represents the economic opportunity and the reality of operation.

Probably, with the accurate digital IP valuation, how to value digital intellectual property and software assets companies can negotiate the terms of investment, organize mergers or acquisitions and optimize the licensing policy. Investors and other stakeholders use these valuations in an attempt to understand long term growth potential, risk exposure and positioning. Strong IP valuation companies are able to use their digital resources as a strategic resource to create innovation, market, and continue to increase their revenues.

Finally, digital IP is not merely a legal right, it has become one of the primary drivers of enterprise value in the contemporary economy. Through the application of strict fiscal evaluation, technical analysis, and hazard examination, organizations are able to release the complete potential of their online possessions, and consequently, innovation can be converted into quantifiable business measurements and long-term strategic benefit.

Valuation Considerations

Economic Life:

The rapid evolution in technology can be attributed to short economic lifespan of software, which is likely to be three to seven years old because of the dynamism of the user requirements. This short-lived span influences the discount rate used in the value models and it has a direct influence on the net present value (NPV) of the digital asset. Appropriate allocation of the cost of obsolescence, replacement, and possible changes in market demand have to be taken into consideration by analysts when calculating the economic life so that realistic and defensible estimated values are achieved.

Revenue Attribution:

Analysts measure the level of what is linked directly to copyrighted materials or software platforms in terms of revenue. This is the separation of the financial input of the digital IP with other operational or secondary sources of revenues. An example is in the situation with subscription-based software, the revenue attribution can be subscription payments, in-app payments, or licensing payments. Proper attribution will be used to make sure that the values will reflect the actual economic value of the IP as opposed to inflating its impact on the overall business performance.

Maintenance and Upgrades:

Subsequent upgrades, security patches and enhancements to the features are also costly, and these expenses influence the net present value of the asset strongly. Largely digital IP needs to be invested in to keep up with the competitive and operational trends, and not taking these expenses into consideration can result in overvaluation. To create a more realistic financial image of the economic impact of the asset, analysts will include the estimated maintenance rates, cost of development and the possibility of technology refresh rates.

Ownership and Listing:Legal Ownership:

There is also the issue of valuation based on a full ownership of the software by the entity, or it is just a supplied third-party code licensing. The exclusive right provided in ownership can be monetized by selling, subscribing, or licensing the asset, but the lucrative opportunity of using the owned asset might have limitations, which hinder the increase of revenues in the case of a licensed asset. The availability and enforceability of the law is directly related to the evaluation of risks, discount rates, and general perceived values of the digital asset.

A combination thereof results in the basis of a credible digital IP valuation framework. Bearing in mind the economic life, revenue attribution, maintenance and legal ownership, firms are able to guarantee that valuation is true and actionable to the extent that it gives one confidence in investing, negotiating a merger and acquisition and reporting the financial results.

Valuation Methods

Relief-from-Royalty:

This approach attaches value to software or digital IP subject to the licensing costs not being paid if the company is a clear holder of the asset. Put very simply, it guesstimates how much it would have cost the organization to license equivalent technology from a third party. Owners can count the dollars as a financial measure of the benefit of ownership by present value calculation of the royalties over the software’s economic life. Activities at Amalgamation This method is extensively used for IP reporting under IFRS 3 and can be seen as a clear, market-based measure for valuation.

Cost Approach:

Cost approach: this approach is most appropriate for in-house developed software, and it estimates the amount it would cost to reproduce or replace the asset. This includes the development costs, testing, management costs, and implementation costs. Accounting for obsolescence and technological improvements as well as presumed inefficiencies, furthermore, is taken into account to arrive at a realistic replacement value. Cost approach sets a conservative course of valuation, particularly while the projection of income in the future remains questionable or the asset has not yet produced notable income.

Income Approach:

The income approach uses discounted cash flow (DCF) models based on incremental revenues that are directly linked to the software or digital platform. Analysts predict the expected revenue streams, deduct operating costs and discount the future cash flows to present value, using risk-adjusted discount rates. This approach accounts for the value of the IP and represents its ability to create continuing revenues. It is especially effective for software products for mature customer bases, recurrent subscriptions or licensing agreements and provides a forward-looking measure of value based on financial performance.

These approaches combined can provide a comprehensive umbrella under which a software and digital IP valuation approach can be considered. By combining relieving from royalties, cost and income solutions, companies can triangulate estimations, ensure adherence to accounting solutions and come up with defensible valuations. Application of these methods can be used to inform strategic decisions in fundraising, M&A, licensing terms and internal capital allocation.

Finally, effective software and digital intangibles valuation turns intangible assets into tangible assets as a contributor to enterprise value. It helps companies leverage technology in a strategic manner, help companies attract investments, and guide companies through an increasingly digital economy with confidence and clarity.

Conclusion

Digital IP is now the heartbeat of enterprise value creation. Accurate measurement of the value of copyright and software valuation methods for M&A and investment can help companies manage innovation strategically while attracting investors and bring the accounting to a measure of actual economic performance. As and when technology-driven business models continue to be mainstays, powerful valuation frameworks ensure that creativity and innovation are recognized as the tangible driving force for tomorrow’s corporate worth.

Furthermore, accurate digital IP valuation can give critical insights to decision-makers and help inform decisions about funding investment priorities, allocating resources to R&D, and (re!)entering into strategic partnerships. Companies that know the financial and operational impact of their digital assets can optimise licensing strategies, structure acquisitions better and can defend valuations in audits or in the due diligence process. This clarity gives an edge to the stakeholder confidence and improves the credibility of the organization in the competitive market.

Ultimately the digital IP is much more than code, content or data; the digital IP are innovation, differentiation and future growth potential. By adopting a rigorous approach of valuing innovation, considering financial, technological and legal perspectives, companies can derive objective enterprise value from intangible innovation. This is to ensure that intellectual property not only fosters current performance, but provides one of the building blocks for long-term strategic performance and sustainable competitive advantage in an increasingly digital economy.