Audit Trail and Documentation in IP Valuation

Audit Trail and Documentation in IP Valuation

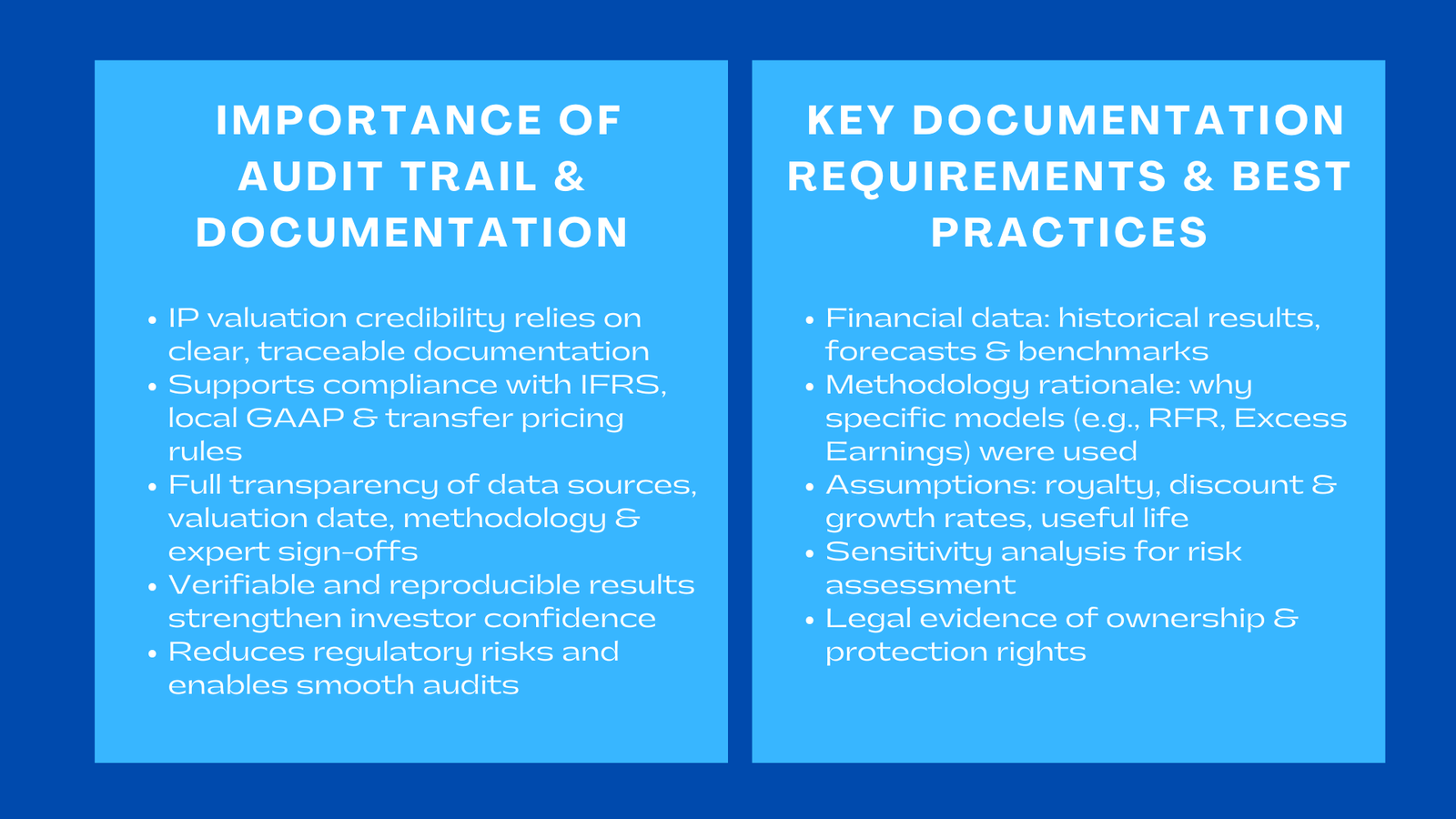

A valuation depends as well as its documentation. All assumptions and inputs in the IP valuation documentation best practices are to be transparent, traceable, and defensible by regulators, auditors, and investors of all data sets and all models of IP valuation. Both compliance and credibility should therefore be anchored on the creation of a strong audit trail. This has to be fully documented with such data sources, the justification of methodologies used, the date of valuation, the level of version control as well as the sign-offs by qualified experts. It guarantees any point of the valuation process that is verifiable and reproducible to meet audit requirements in IFRS, local GAAP as well as in the transfer pricing provisions. The detailed record-keeping does not only reduce the category risks associated with regulations, but also gives the decision-makers assurance that the results of valuation are of real economic substance.

An effective audit trail is not just an act of compliance with the regulations of the business setting, but also a pillar of corporate security and accountability. A firm with a well kept documentation builds strong investor confidence, smooth audits and low chances of financial restatements. Additionally, there are strong valuation records that help in further appraisal in case of impairment appraisals, lawsuits, or taxation appraisals. In the modern context of increased scrutiny and value creation based on intangibles, well-regulated organizations and those with high risks of compliance and credibility liabilities both stand out due to their easily accessible documentation of IP valuation. Finally, continuous audit documentation turns the process of valuation into a permanent financial affair instead of a financial exercise that is carried out once and once.

Core Documentation Requirements

Primary data: previous financials, projections and industry standards.

Rationale Methodology Reasoning behind valuation strategies.

Assumptions: As follows: Royalty rates, growth rates, discount rates, useful lives.

Sensitivity analysis: Proving the effect of valuation in other cases.

Court evidence: Evidence of possession and area of protection.

All these elements are the pillars of an IP valuation that can be argued. Source data makes the financial contributions have some basis in reality and be related to the business performance, and having a clear rationale of methodology gives the transparency of why some such valuation models as Relief-from-Royalty or Excess Earnings were adopted, not others. The major assumptions have to be well defended and justified to avoid exaggeration or addition of bias. Sensitivity analysis also increases credibility as it demonstrates what happens to the valuation outcomes under divergent conditions enabling auditors and other stakeholders to gain an insight on the exposure of risks. This is especially important in intangibles valuation Singapore for corporate finance, where accuracy and transparency directly impact strategic and financial decision-making.

Lastly, the valuation is legal evidence, which confirms existing enforceable rights to ownership and assures that the company has control over the resulting economic value on the IP. Collectively, these aspects do not just pass compliance standards in the spirit of the IFRS and audit requirements, but also show analytical rigor and high standards of governance. Practically, a valuation that the extensive documentation is substantiated with gives more credibility on the part of the auditors, investors and regulators in the reported value of the IP; as to being both economical and legally assured.

Best Practices for Maintaining Audit Readiness

Ensure periods of similar valuation policies.

Document all the valuation models and research.

Compare the outcomes with previous appraisals and business strategies.

Internal check and authorization by top management.

The practices will make sure that the valuations of the intellectual property are transparent, auditable, and in line with the internal governance standards and external reporting standards. Stability with respect to reporting periods can be used to avoid anomalies that may attract the red flag in the case of audit or regulation checks. Having consistent valuation methodologies and assumptions, unless there is a material change in business, companies provide a stable record of performance which increases investor confidence and book audit confidence.

The saving of the valuation models and research also gives a complete historical record, where auditors and those doing that research in future can be able to track all inputs, computations and origin of their data. The reconciliation of results against the previous valuations and business forecasts will also make sure that reported values are not only correct, but also they are maintaining an audit trail for intangible assets contextually sound to the business direction and performance of a company. Lastly, formalized responsibility is done by taking the valuation products to internal review and executive score which serves to reinforce the notion that the valuation products have been examined under close scrutiny. With all of these steps as an organized part of a discipline, the integrity, reliability and credibility of any IP valuation carried out within the organization is nurtured.

Conclusion

The audit-ready ip valuation is trustworthy and resistant to examination by the regulators, investors, and even auditors. Complex documentation will provide transparency and continuity to the financial reporting with reduced compliance risk. Over the long run, the companies that practice disciplined valuation records are able not only to comply with the requirements of the auditing, but also to acquire a strategic edge as well, since credibility is the ultimate intangible asset.

Communication In addition to compliance, the ability to keep audit ready documentation is what changes valuation, which is not a pillar of corporate governance but a technical exercise. It will indicate to its partners that the administration has been aware of the monetary worth of its intellectual property and strives to be truthful in reporting. In the long run, this predictability will increase investor confidence, ease the audit process and improve the reputation of the firm in the capital markets. In the current economy, where intangible resources dominate the enterprise value, sound IP valuation practices are not merely ensuring the auditors are not satiated, they are concerned with preserving the financial identity and approach of the company in terms of its long-term strategic position.