Building Strong Audit Trail for IP Valuation

Audit Trail and Documentation in IP Valuation

Introduction to Building Strong Audit Trail for IP Valuation

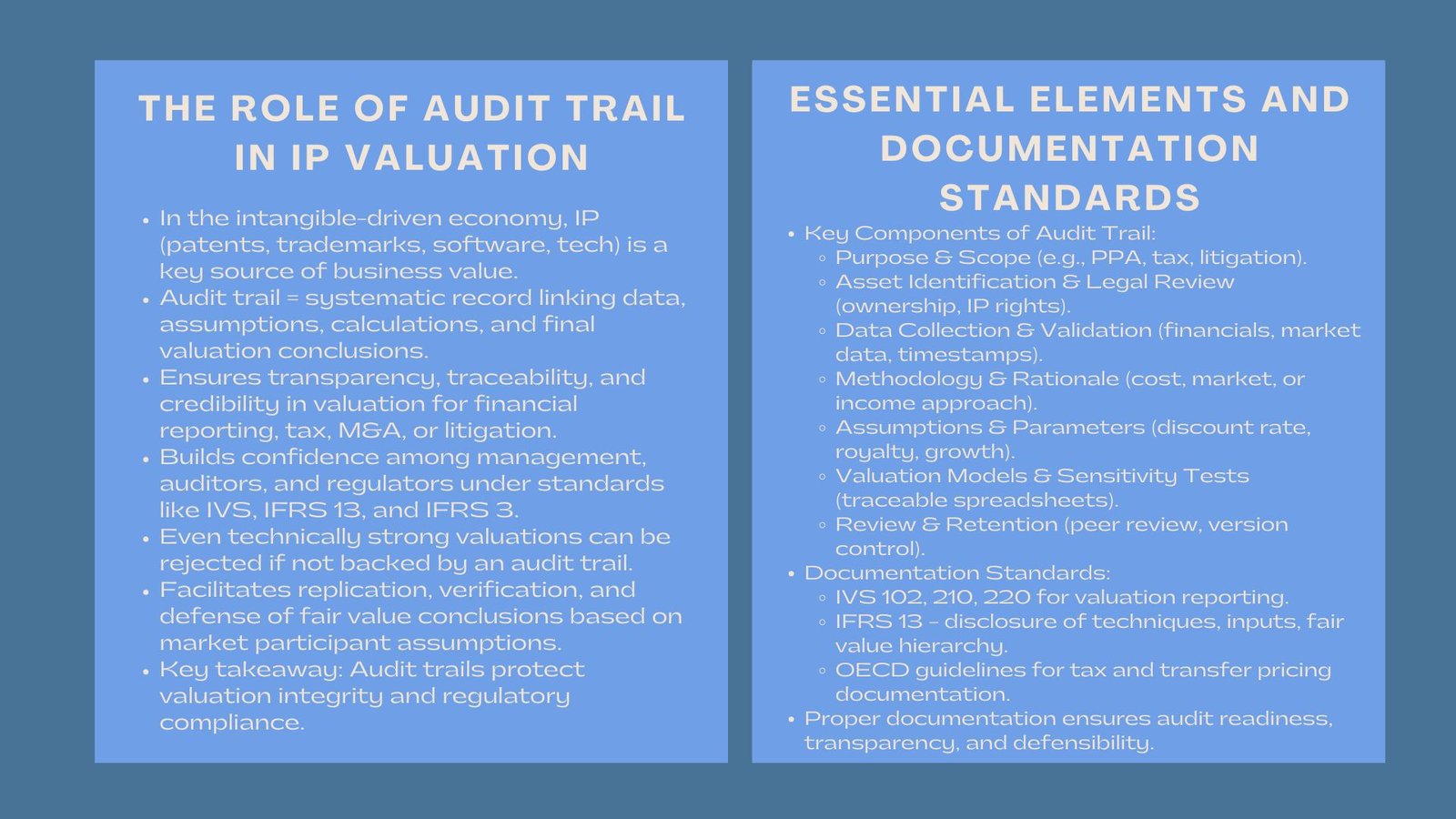

With a growing economy dominated by intangibles, intellectual property (IP) has become the major source of business value. Competitive advantage and market value is determined by patents, trademarks, software, and proprietary technologies. However, when such assets are assessed, be it in financial reporting, tax compliance, mergers or litigation the credibility of the outcome relies not only on the process but on the number.

Effective audit trail and extensive documentation are the pillars of transparency, defensibility and compliance with regulations of IP valuations. They give a clear account of how assumptions were formulated, how data was obtained and how the final conclusions were reached. Under a regime of stringent accounting standards and an increased level of regulatory scrutiny, documentation has now become not only best practice but an essential protection to businesses, auditors and valuation professionals of all kinds.

Audit trail Role in IP Valuation.

Any defensible valuation is founded on an audit trail. It is the systematic record which connects the raw data, suppositions, computations and conclusions. This trail of evidence should also be used in IP valuation whereby the valuer should demonstrate how they arrived to a final decision of fair value only that every value can be traced to a verifiable source.

It has an efficient audit trail which helps in the internal validation and external review. To the management, it boosts the confidence of having good logic and credible figures underlying the reported asset values. It gives auditors and regulators confidence that valuation work meets the standards in use, e.g. the International Valuation Standards (IVS), IFRS 13 on fair value measurement and IFRS 3 on business combinations.

Even technically good valuations can be doubted or denied without an appropriate audit trail. An adequately documented procedure facilitates testing of inputs by auditors and replication of results and also ensures that valuation is based on market participant assumptions, and not on internal bias.

Why Documentation Matters

Documentation has many different uses: it can illustrate professional rigor, simplify review and provide regulatory compliance. It is also used as a reference point in future testing of revaluations, impairment testing or dispute resolution.

Good documentation narrates a whole story not only of the valuation result, but also a narration of the journey that has brought one to the valuation result. It must outline the use of the valuation, the nature and legal rights of the asset, the main assumptions, methodology selected and all the sources of data used.

In case of complex valuations where multiple intangible assets are involved, documentation also facilitates the internal consistency. To illustrate, the discount rates or economic life, or royalty standards applied in the various types of IP have to be consistent with each other to create a consistent system of valuation.

Important Elements of IP Valuation Audit Trail.

An audit trail needs to be well planned with a complete scope of the steps that should be followed in the valuation process, including data collection and model results. Although the format can differ, some of the parts are always expected:

Intention and Scopes of Interaction.

In this section, it is explained why the valuation was done, i.e. purchase price allocation, financial reporting, transfer pricing, or litigation. The scope also determines what assets will be covered and what standard will be utilized to analyse the asset.

Asset Identification and Legal Review.

It is necessary that the intellectual property should be properly identified. There should be a record of legal ownership data, registration, territorial rights, and encumbrances. In the case of proprietary technology or trade secrets, an internal evidence is sufficient to prove the existence of the asset, and this includes reports of R&D, source code documentation, or documentation of the product.

Collection and validation of data.

Every input has to beable to be traced back. This entails financial reports, management projections, industry reports, and market transactions reports. There should be a clear data log showing how and when every source has been received, and the data quality measured.

Methodology and Rationale

The valuation technique applied which could be cost, market or income approach should be supported where the IP is in nature and evidence. This part ought to explain the reason why some of the methods were not included and how sensitivity tests were done to verify the accuracy of findings. Many firms integrate audit-ready IP valuation documentation and compliance review framework to ensure every methodological decision is properly supported and reviewable.

Assumptions and Parameters

The important assumptions are discount rates, royalty rates, growth forecasts and economic lives which should be properly recorded. Evidence in support — market benchmarks, risk analyses, and expert opinions are to be mentioned to support these inputs.

Valuation Models and Calculations.

Spreadsheets and financial models should be versioned and should not contain any hardcoding that is not well explained. There must be a way of tracing every single figure in the final report to source data by reviewers. The use of annotation, cross-referencing and logical file naming is used to ensure coherence in the audit trail.

Results, Sensitivity Tests and Reconciliation.

The final value should not be the only value that is documented but also alternative scenarios, reconciliation of approaches and notifications of any material differences. Sensibility Analysis shows the impact on the valuation of the main assumptions, which supports the plausibility of the valuation.

Review, Approval and Retention of Records.

The last phase is the internal quality control, peer review and formal approval. Storing all the working papers and supporting evidence over a specific duration will make it ready in the case of another audit or regulatory review.

The norms that regulate IP valuation documentation.

There are a number of international standards that focus on the documentation with respect to intangible assets valuation. General reporting principles are contained in the International Valuation Standards (IVS 102 and IVS 210), whereas specific considerations of intangible assets are presented in IVS 220. On the same note, IFRS 13 requires the disclosure of the valuation techniques, inputs and fair value hierarchy levels.

Guidelines of OECD on tax and transfer pricing have contemporaneous documentation on assumptions and comparables. Regulatory authorities on the different jurisdictions e.g. SEC, HMRC, and ATO require that valuation analyses stand the test of time with a consistent, transparent, and well-documented trail of evidence.

Firms that adopt international best practices in IP valuation audit trail documentation and recordkeeping systems typically achieve smoother audits and greater confidence from both investors and regulators.

Pitfalls and How to Get Out of them.

Nevertheless, most organizations fail to keep proper valuation records despite the best efforts being made. Possible traps are unfinished data records, assumptions that have not been documented, or use of an outdated information. Other people do not trace model results to the inputs therefore it is not easily reproducible.

To prevent such problems, valuation teams need to develop clear internal documentation procedures, standardize templates, and have a version control. Cross-referencing and data logs with timestamps can be used to improve transparency and traceability, whereas regular peer reviews can reveal gaps at an early stage, and digital audit trail tools can be used.

The Increased Function of Technology in Audit Trails.

Digital transformation has changed the way valuation documentation is done. It can now be automated through sophisticated modeling software and audit management systems to capture data, safely store the data and have electronic reviews trail. Real-time sharing of valuation teams, auditors, and clients can also be provided with the help of the cloud-based collaboration platforms.

Technology improves efficiency as well as compliance. Automotive systems minimize error in manual processing, provide standard practice and make every change and approval trackable. The increasing regulatory demands and the need to meet the increasing expectations of digital regulatory requirements has made digital audit trail integration a viable strategic investment in environmental reliability and compliance assurance of operations.

Audit Trail as a Quality Assurance Tool.

In addition to compliance, a detailed audit trail enhances the valuation work in general. It promotes critical discipline, colleague responsibility and accountability as a professional. Any step that is recorded is considered a quality control measure minimizing the chances of negligence and enhancing the integrity of the end product.

An effective audit trail also increases the trust of the stakeholders, as far as governance is concerned. The investors, the auditors and the regulators would feel more confident working with technically sound valuations that are provable.

Conclusion

An IP valuation should not be judged solely by the end number it generates but also by the quality of the process leading to the end number. Openness and justifiable accountability Modern financial and regulatory environments require is granted by a detailed audit trail and an extensive documentation.

Valuation professionals can also be sure that their work will be well-scrutinized by keeping clean records of data, assumptions, and methodologies with the help of technology and in line with international standards. The audit trail is no longer a compliance practice in the age of intangible assets, but rather the backbone of the credibility of valuation and trust in the professionals.