Certified Trade Secrets Valuation Course

Valuing Trade Secrets and Proprietary Know-How

Guide on Certified Trade Secrets Valuation Course

Trade secrets and proprietary know-how are often the hidden competitive advantage of the company. Unlike patents or trademarks, trade secrets are not publicly registered, but may be some of the most valuable intellectual property (IP) assets in industries where innovation and process efficiency are the keys to success – such as biotechnology, manufacturing and software development.

Valuing trade secrets involves a mixture of financial analysis, knowledge of the law and strategic context. Due to the fact that their value relies a lot on their capability to do so, valuation specialists should be taking into account economic advantages that come from staying one element ahead of competitors. This includes estimating the heightened profits or cost savings produced by proprietary processes, formulas and methodologies that can not easily be replicated. Other considerations, such as the risk of misappropriation, the likely length of time of secrecy, and the need for continued investment for competitive advantage, are considered by analysts.

Financial approaches to valuing trade secrets often include income-based approaches, which show the projected cash flows from proprietary knowledge, reduced to the present. In some cases, cost-based approaches are employed to estimate how much will be charged for building an equivalent capability internally. Such legal factors as enforceability of confidentiality agreements and employee non-compete clauses also matter in determining valuation by reducing the possibility of disclosure or destruction of competitive advantage.

Strategically, this insight into the value of trade secrets helps companies make informed decisions about mergers and acquisitions, resource allocation within their companies and licensing opportunities. It also has a role in risk management to ensure that critical knowledge is appropriately protected and leveraged to gain maximum profitability. A comprehensive and well-structured valuation framework is a balancing act between the confidentiality, financial impact, and sustainability of operations in order to identify the true economic contributions of these intangible assets.

Ultimately, trade secrets and proprietary know-how is more than mere hidden information, it is a strategic asset providing the basis for innovation and competitive positioning. By rigorously evaluating what is valuable, organizations can ensure protecting their intellectual property, making better decisions and gaining a better long-term advantage in the markets where knowledge is a major driver of success.

Understanding the Nature of Trade Secrets

Trade secrets are formulas, designs, algorithms, manufacturing processes, or customer data that are proprietary to an individual or business and which supply a competitive advantage to the company; trade secrets are privacy, top secret, non-disclosure agreement (NDA), and intellectual property (IP). Unlike patents, protection lasts forever – as long as the confidentiality remains. This infinite protection is what makes trade secrets extremely valuable especially in industries where the innovation cycle is long, replication by competitors expensive or time-consuming. Properly protecting these assets by having strong legal frameworks, employee training, and operational controls is critical to maintaining the economic benefit of these assets.

The difficulty in the valuation process is the intangible nature of the mechanism of protection and the difficulty in separating out financial benefits resulting only from the secret. Analysts must separate the value of the trade secret from other business assets, for example, brand value, patents or operational capabilities. This often has to do with estimating the incremental amount of revenue, cost savings or market share gains that are directly related to the proprietary knowledge. Risk assessments, for example, potential misappropriation or disclosure, also impact on discount rates and valuation results, as the loss of secrecy can lose all the economic benefit of the asset entirely.

In practice, how to value trade secrets and proprietary know-how a combination of income, cost and market-based approaches are utilized frequently in an attempt to triangulate a defensible value for a trade secret. The income-based methods guess future cash flows that wouldn’t be possible without the secret that discounted for risk and uncertainty. The cost-based methods take into account the cost of developing a similar capability in-house, whereas the market-based benchmarks, less prevalent but still quite possible, can reference licensing agreements or transactions in which similar proprietary knowledge has been sold.

In the end, trade secrets and proprietary know-how are crucial strategic assets that are the key drivers of competitive differentiation and profitability. By using rigorous valuation approaches and keeping stringent confidentiality, companies can quantify, safeguard and leverage these intangible assets effectively in order to ensure that they contribute meaningfully to enterprise value and long-term success of the business.

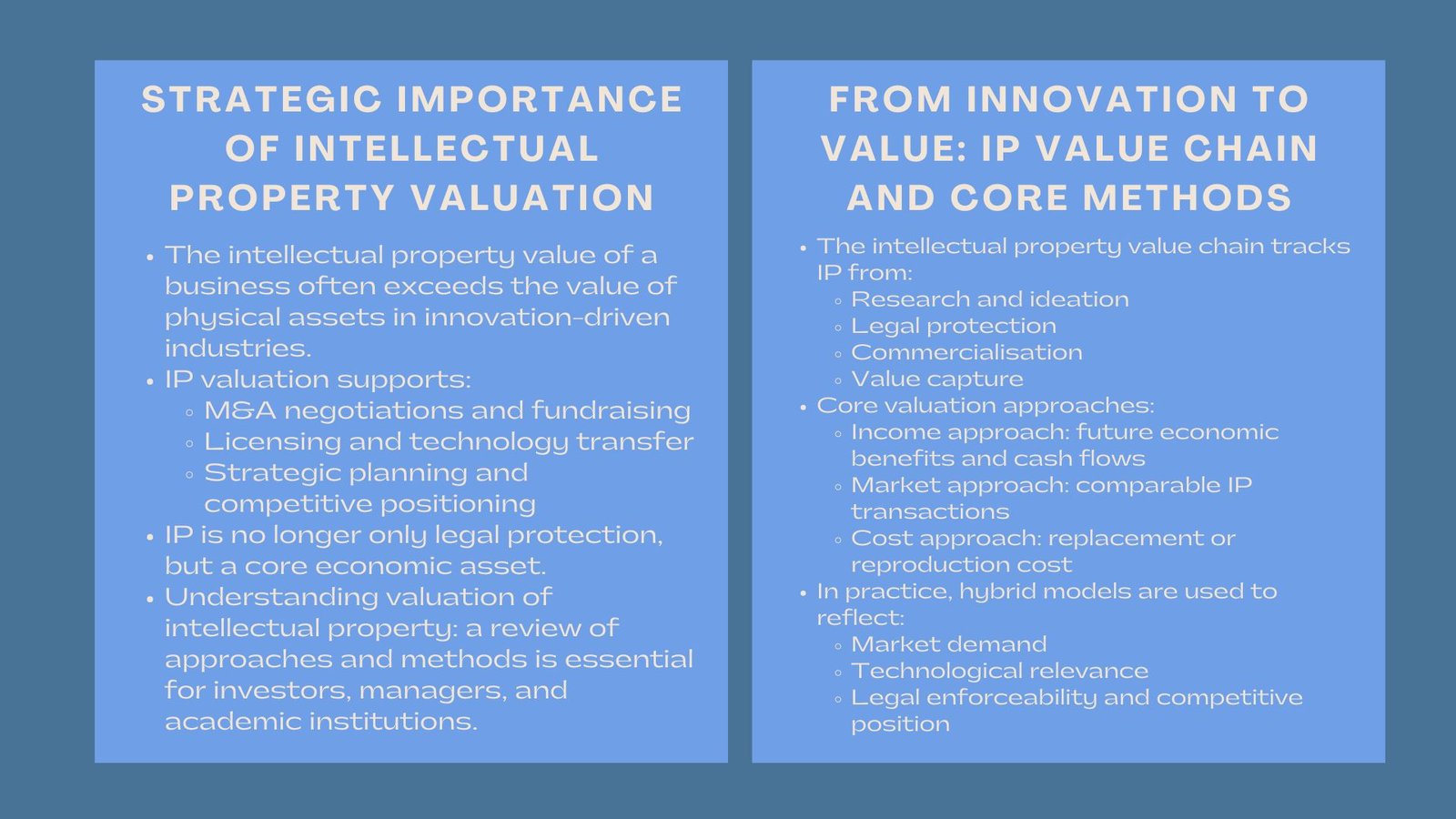

Valuation Approaches

Income Approach

The income approach is an income cost and market approaches for trade secret valuation estimates of the present value of the future cash flows expected to be attributable to the trade secret’s exclusive use. Analysts value incremental profits that the trade secret generates in comparison to competitors by evaluating how the trade secret helps boost the revenue, cut costs or preserve market share.

Consideration is also given to the life cycle of the product, however, to ensure that the valuation reflects the period of time that the secret enjoys a competitive advantage. Additionally, risks such as potential disclosure, technological obsolescence, or replication of the process by other companies, are taken into consideration when valuing investment-based processes, so that the valuation realistically reflects uncertainty and sustainability of the benefits.

Cost Approach

The cost approach is the measure of the costs to recreate or replace the secret knowledge and will include cost of labor, materials, research and development costs, project management and so on. Adjustments are made for the effects of inefficiency, obsolescence, and the natural risk that the recreated knowledge may not have identical operation effectiveness. This approach is useful in providing a conservative value for the baselines, being especially valuable if future cash flows are not so clear or if the trade secret is in an early stage of development.

Market Approach

The market approach is used in the case of comparable data of licensing or acquisition, for example, royalty rate (for technical know-how) of similar industries. By conducting transaction analyses on transactions made over the proprietary types of knowledge, analysts can compare the value of the trade secret to market standards. Adjustments are made for differences in industry, scale, geographic reach and legal enforceability to ensure that a fair comparison is made. While less applicable, due to the confidential nature of trade secret, this approach could validate income or cost-based valuations and could add credibility to the negotiations or financial reporting process.

Together these three approaches provide a holistic and comprehensive approach to valuing trade secrets and proprietary know-how. And by triangulating the estimate from all three perspectives – income, cost, and market – companies can build defensible valuations that weigh into strategic decision making, M&A transactions and licensing agreements, as well as financial reporting.

Ultimately, before any valuable trade secrets can be exploited and put to good use, they must first be estimated in terms of enterprise value – but strict trade secret valuation city transforms hidden knowledge into something more measurable. It allows organizations to protect innovation, measure competitive advantage, and make sound decisions about where and how to invest, protect and commercialize proprietary assets to ensure long-term strategic growth and differentiation in the market.

Key Valuation Challenges

Trade secrets and proprietary knowledge have a number of inherent problems which will need careful handling. One of the problems is the absence of market transparency. Unlike patents or publicly traded assets, trade secrets are confidential in nature and comparable transaction data may be difficult or non-existent to access. This creates challenges when benchmarking and makes analysts highly dependent on internal financial and operational data – requiring them to make assumptions and exercise professional judgment.

Another challenge is the difficulty of disconnecting the value of the trade secret in the business from other business assets. It can be difficult to isolate the incremental value of trade secret information without other sources of value provided by patents, brand equity, technology infrastructure, and operational dynamic because often these facets of company value are synergistic with the proprietary knowledge. To properly model the strategy, it is essential to grasp an understanding of the business operations, the competitive position and the specific economic advantage to be gained from the secret.

It is also important to estimate the risk of leakage or obsolescence. The value of a trade secret decreases when access to the trade secret by competition or changes in the markets or technology evolve fast. The period to which competitors will likely have access to the secret, the longevity of the competitive advantage of the secret and the expected economic life of the knowledge are factors that the analyst should also consider when using an income-based or cost-based valuation technique.

Finally, knowledge can be subject to collaborative processes and shared among employees, which can make it difficult to determine ownership. Well, to establish control and enforceability, it is vital to incorporate clear legal agreements, non-disclosure agreements AND their correlate internal policies. As a result, the lack of clarity of ownership can have a direct impact on the perceived value of the trade secret and the ability to realize economic value from the trade secret whether through licensing or selling the trade secret or exploiting the trade secret for strategic purposes.

Despite these challenges, a rigorous valuation system that incorporates issues of transparency, incremental contribution risk, obsolescence risk and ownership allows for a defensible estimate of the trade secret’s value. This allows companies to use proprietary knowledge strategically for safeguarding competitive advantage and adding more value to the enterprise.

Conclusion

Trade secrets are silent assets – invisible but crucial to being competitive. Their valuation must take into account operational relevance, legal enforceability as well as commercial viability. By assessing proprietary know-how, companies can be better prepared to articulate the dollar value of the know-how across balance sheets, fund-raise, and form stronger partner agreements. This should ensure that whatever isn’t seen becomes a force that powers tangible business growth.

Further, trade secret valuation supports the strategic decision-making process by giving a clear picture of which processes, formulas or methodologies have the biggest impact on profitability and competitive differentiation. There is proof that firms which are disciplined in evaluating the economic effect of their own knowledge can target the investment in that knowledge, protect the knowledge assets and thus allocate the resources more efficiently. This proactive attitude not only ensures the reduction of risk but also leads to the economic potential of such intangible assets.

Ultimately, trade secrets are a convergence of innovation, talent, and excellence in the operating noise. By using rigorous valuation models and robust expressivability protection, enterprise intangibles can be developed from tacit-to-eminent sources of enterprise value. This guarantees that proprietary knowledge remains the pillar on which sustainable development, market dominance and business stability can be based in the long term.