Importance of IP Valuation for Investor Confidence Singapore

Learn Importance of IP Valuation for Investor Confidence Singapore

The value of some intangible assets can constitute a large percent of corporate value in the modern knowledge economy. The intellectual property (IP), including patents, trademarks, copyrights, and trade secrets, safeguard the innovation of a business in addition to their crucial functions concerning capitalisation and strategic development. But in order to utilize these assets to their potential advantage, particularly in transactions with investors and lenders, a clean, credible valuation is fundamental. Many companies now rely on professional patent valuation services Singapore, IP valuation services in Singapore, and expert intangible valuation in Singapore to ensure that the value of their intellectual property is assessed accurately and defensibly.

The article discusses valuation of intellectual property as a way to support financing decisions, which improve the confidence of investors and aid in obtaining improved funding results by businesses. We shall discuss why IP is important in the modern economy, why investors are valuing intangible assets more now than before, how to perform a credible valuation and its significance in enticing investment and liaisons.

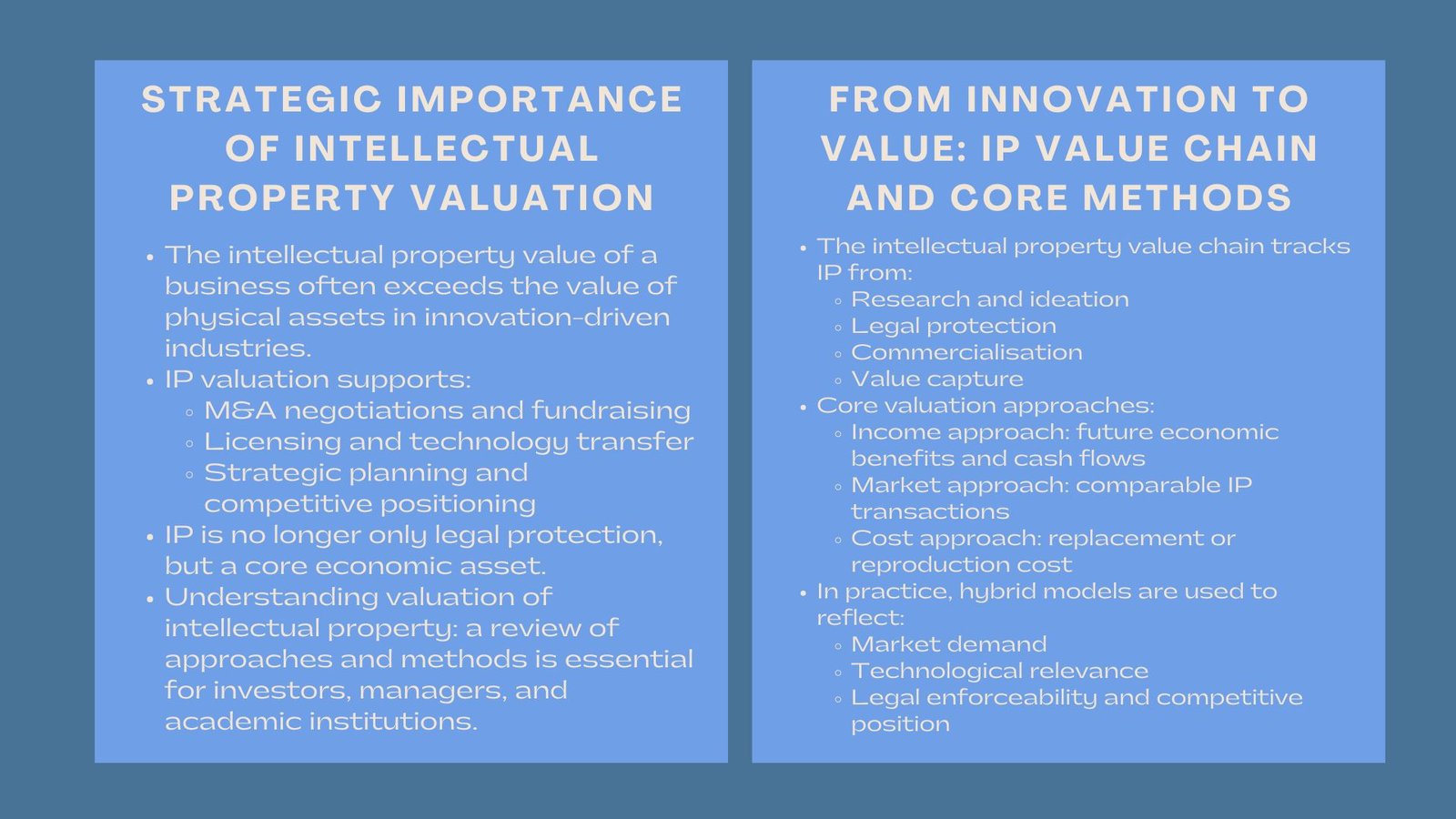

The Growing Significance of IP in Business Valuation

In most contemporary businesses, especially in technology, life sciences and creatives, intellectual property may form much of the value of an enterprise. This is not always reflected in traditional ways of accounting where the emphasis is more on physical and financial resources. However, what often causes the business differentiation and competitive advantage these days is the ideas, innovations and brand recognition and, traditionally, these factors are currently being secured by the IP rights.

Business corporations such as Apple, Google and Microsoft have shown businesses that intangibles can be worth a fortune. Proprietary technology or branding may be an important profitability and investor advantage even among small, and medium-sized enterprises (SMEs). Thereupon, the process of IP valuation being included into the financial story of a company is viewed as a more of a strategic demand rather than as an afterthought.

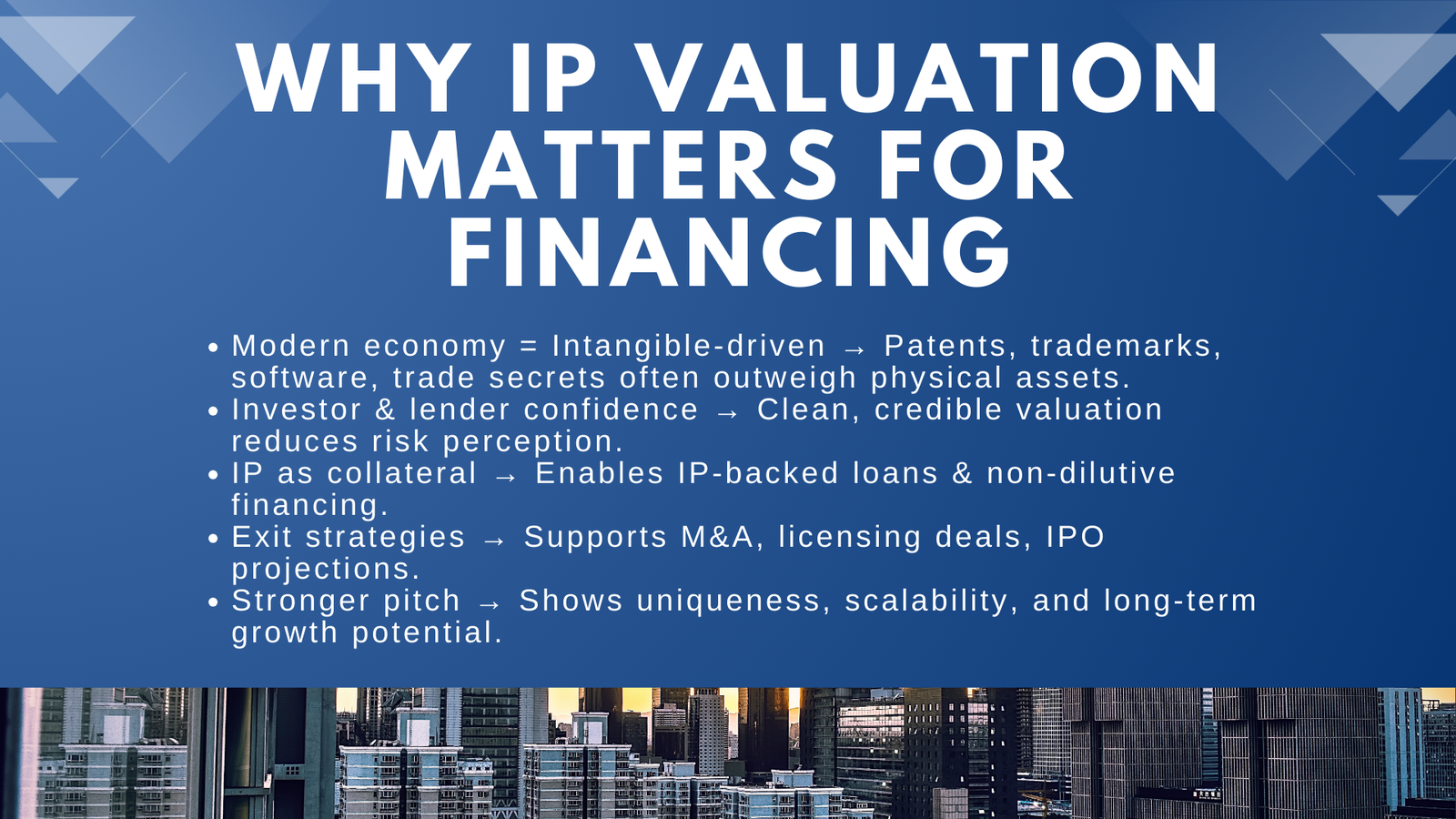

Why IP Valuation Matters to Investors and Lenders

Risk and returns have an inherent interest to the investors. In considering a business, they would like to hear and know how it is unique, sustainable and scalable. All of those three concerns can be answered by IP. As an example, the patent can secure the company against the competition over 20 years, whereas a powerful trademark can guarantee brand awareness and client loyalty over the years.

On the side of lenders, IP assets can be used as security particularly where (actual) assets are scarce. This creates opportunities fro IP-contingent financing and non-dilutive forms of financing that do not require the release of equities. Nevertheless, the valuation of the IP needs to be documented, detailed, and defensible to the financial institutions to make such strategies successful.

Further, an IP valuation is a credible exit plan to the venture capitalists and a private equity firm. It aids in modelling acquisition or licensing revenues or IPO projections. A clean and explainable value of IP can accelerate due diligence and provide it with decisiveness.

How to Value Your Intellectual Property

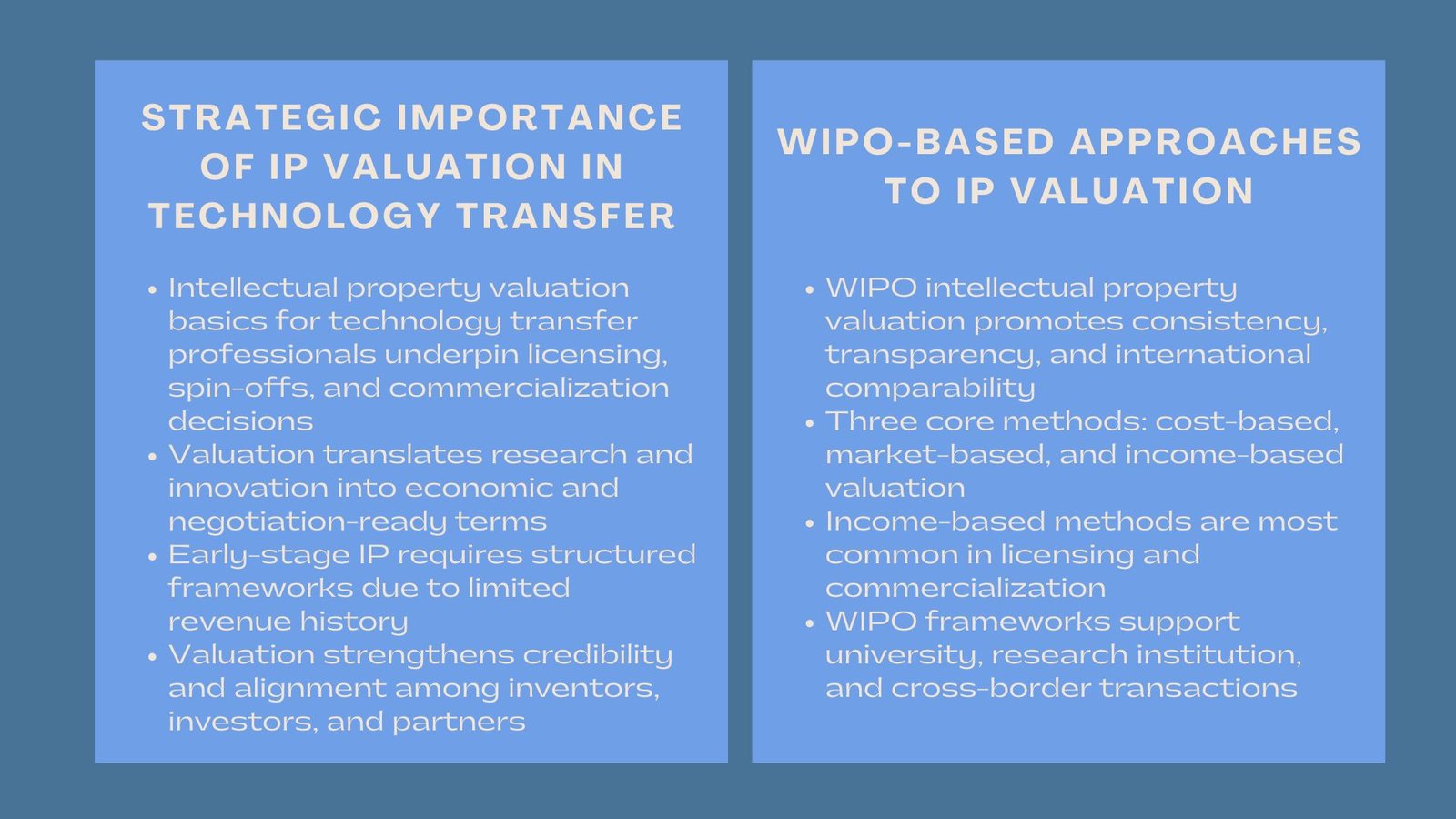

Valuation of intellectual property has a number of established approaches, and each is appropriate to various forms of IP and business scenarios. One of the reasons is the nature of the asset to be valued, the task in which the valuation should be carried out (e.g., M&A, financing, litigation), and the possibility of finding the necessary data.

- A cost based method takes into account the cost incurred to produce or substitute the IP. It is also a common method where the market comparables cannot be used, and it may undervalue the economic value of the asset.

- Market-based approach relates the IP to the other assets that are similar by comparison but which have been sold or licensed on similar terms. Such an approach works well in case there is a clear market on similar IPs, but when it is not the case, the data may be limited.

- The income-based method makes a projection regarding the economic benefits which the IP will bring in future, and discounts the same to the present value. This is the universal practice in the field of technology and innovation, most so in the case of patents and software.

To be credible to either the investors or the banks, the valuation ought to be carried out by a qualified practitioner who is independent and should be conversant with both intellectual property law and finance. Entailing valuation reports and risk assessments is very important in terms of building investor confidence.

Strengthening Your Financing Pitch with IP Valuation

The need to have a good and recorded valuation about IP can highly boost your credibility in the eyes of financiers. It puts your business not only as a source of income, but as a long-term business with growth potential. The more investors can tell where the value is and how it is carved, the better they will be attracted to a pitch.

When it comes to startups, the focus on a key IP portfolio an individual can mention patent applications, software codes, trademarks, or even vegetative secrets can divert the discussion into the direction of secure growth rather than hypothetical growth. That is even a more serious case when the IP is already bringing in revenue through licensing.

Later in the development of a company, IP valuation can allow higher valuation multiples to be used in fundraising rounds, in cases where the IP enables scalable activities, international markets, or barriers to competition. It is even capable of justifying high prices of acquisition in tactical exits.

Government grants and R&D tax breaks in most jurisdictions are also rewarding when it comes to innovation. The rationale behind such incentives can be recorded in an IP valuation and can be used as support to sustain the company funding ecosystem not solely based on the use of private capital.

Common Challenges and How to Overcome Them

Although the usefulness of IP valuation is evident, a dependable one is not executed without difficulties. Most firms do not have in-house intellectual property experts. The records that should be used to determine the value of the property, including evidence of ownership, repair expenses or income, may be given or undistributed at times.

Besides, valuing the future of an asset that is an IP is surrounded with uncertainties in the field of market adoption, obsolescence technology and the risks involved in enforcement. This renders the process of valuation very judgmental and complicated.

The first measures that should be taken by businesses in order to reduce such risks include getting the IP portfolio organized. Make sure that there is the registration and renewal of rights. As far as it is possible, relate the IP to product lines or revenue streams in order to facilitate the process of income attribution. Brush up IP and valuation experts at the earliest, and in the case of possibly upcoming fundraising.

The other pointers, do not wait til a transaction or financing round to consider IP value. It ought to be included in your current strategic planning. There should be regular update of valuations, particularly where new patents or trademarks are registered helps to keep your data up to date and therefore defensible.

Building Long-Term Investor Relationships Through Transparency

Investors like clarity. A properly developed IP valuation shows that a company is aware of its value determinants, and it does not take them lightly. It lessens doubt and instigates trust, and creates a professional cadence.

Also, IP valuation does not happen once. The portfolio varies as the business changes-new technologies, markets, and regulations arise, and current technology markets shift. Maintenance of their investment base by keeping investors updated via periodical updates or presentations at the board can secure the relationship and provide an avenue of follow-on investment.

Through making IP a part of your company story and through your investor messaging, you are telling not just a story of today but you are telling a story of tomorrow and opportunities. It is especially critical where the revenue can be lumpy or where the scaling entails making an upfront investment.

Conclusion: Turning Ideas into Investable Assets

Intellectual property is legal protection, but in a crowded business environment it is a strategic currency. Proper valuation of your IP can open the doors to funding, attain publisher interest and support high valuation. To raise money at any stage, whether it is a launching startup pitching to angel investors, or a growth stage firm getting Series B financing, it is important to be able to know and tell what your intangible assets are worth.

The IP valuation is the area that fills the gap between innovation and investment. When properly executed it can convert ideas into investable assets so that companies can generate and raise funds, diversify their operations and realize their long term growth. The businesses that appreciate and quantify the value of what they develop, and maximize these values are successful in the future and the intellectual property is the core of the value.