IP Valuation for Licensing Franchising and Royalty Agreements

IP Valuation for Licensing, Franchising, and Royalty Agreements

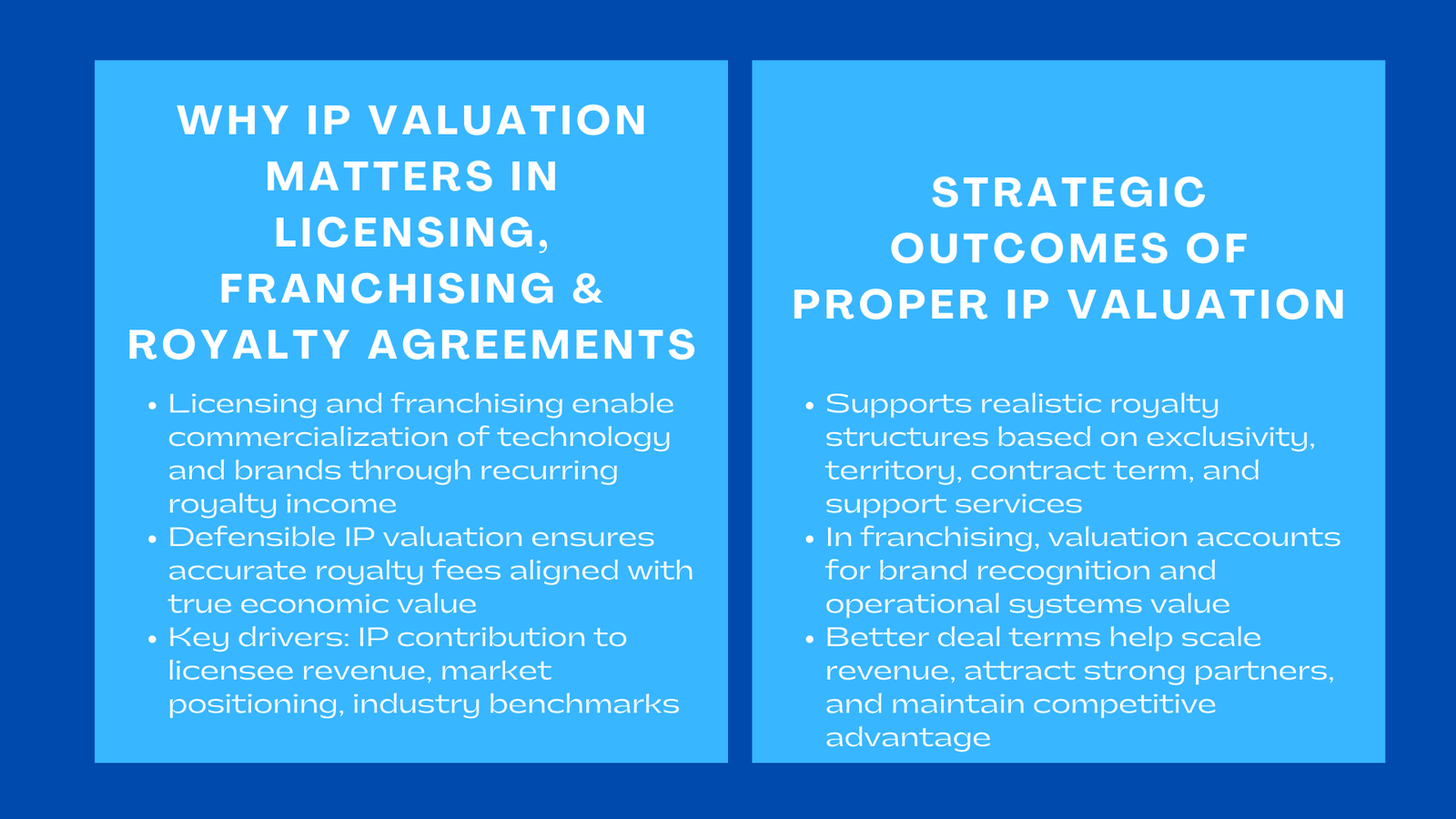

Monetizing intellectual property can be achieved through licensing and franchising, which are considered to be most efficient. The idea is that the technology transfers (as well as brand licensing) result in the continuous revenue streams – however, only provided that royalty fees are calculated with the help of defensible and market-based IP valuation. To create a reasonable royalty system, it is important to know the contribution of the IP to the revenue of the licensee, positioning in the market, and the standards in the industry. Incorrectly estimating the amount of royalty paid or paid too much can have major impacts on the profitability, tax paid, and the sustainability of a long-term partnership.

An effective valuation exercise involves benchmarking analysis, previous licensing deals, and financial AHP to ascertain that the royalties which are agreed upon are reflecting the actual market forces. Such important variables are the exclusivity, rights to the territory, time, and the support service. In the case of franchising, brand recognition and systems of operations provide other levels of value which need to be measured meticulously. Open valuation models are also effective in supporting negotiation of the contract and decreasing the cases of disagreement with the adjustment made due to the performance or renewal reasons.

Finally, proper IP valuation for licensing agreements Singapore in the procedure of licensing and franchising is not a mere compliance practice, it is a strategic instrument. The royalty rate which equates to real economic value helps businesses to attain the maximum possible revenue, get quality partners, and maintain brand strength in the long run. Moreover, well documented valuation methodologies would be more defensible on audit as well as tax inspection while assuring the licensor and the licensees of confidence. When faced with an ever more IP-based economy, those companies that manage to perfectly package their intangible assets not only enable the creation of sustainable and scalable sources of income but also seal the competitive edge that they have on a global scale.

Valuation Process

Identify the IP Type:

Know-how of technology, brand, design or process. The initial stage towards appreciating IP in the context of a license or a franchise is the type of intellectual property being sold off or used. All categories of IPs like patents, traders marks, or a proprietary know-how have their peculiarities and revenue potentials. As an example, technology IP can lead to efficiency or technology, whereas brand IP increases consumer confidence and pricing strength. Proper recognition of the type of IP is important to avoid wrong valuation techniques and hypotheses, and the asset character and value are properly captured and demonstrated, especially when conducting IP valuation in business combinations under IFRS 3 Singapore.

Benchmark Market Rates:

Establish a market range with the use of royalty rate databases and similar transactions. Benchmarking entails considering the licensing transactions in other related industries or regions to find out the percentage of revenue or profit that is normally paid regarding the binding of the comparison IP. Empirical data can be obtained with the help of such reliable databases as RoyaltySource or ktMINE. Analysts also take divergences on market position, exclusivity and maturity of IP to revise standards. It is imperative that the right benchmarking is done to make sure that the resultant valuation stands commercial and tax scrutinies.

Knowledge,–Do as I say, King–дела]\|relief|>Use the Relief-from-Royalty Method:

The value should be estimated by the cost of license evaded and the projected revenue base of the asset. The given approach presupposes that the company would otherwise be paying a third party an authorization to use the IP. The analysts can then come up with the fair value of the IP by using a suitable royalty rate on the projected stream of revenue and discounting it to the present value. Under the IFRS 3 and transfer pricing compliance purpose, this approach is largely acceptable thus it is highly favored in both the context of M&A and licensing.

The Adjustments made towards risk and exclusivity:

Take into account geographic rights, terms of support and term. The royalty rates need to be modified depending on the risk factors that include technological obsolescence, brand stability or regulatory risk. On average exclusive rights will have higher price, whereas limited period licenses or region license can be subject to discounts. By the same token, when the licensor is offering technical or marketing support, the additional value drivers should be reflected on the valuation.

The way these steps have been organized is that the companies not only achieve that the IP valuation of licensing or franchising is defensible, compliant and reflective to the actual market conditions. Having a strong and clear plan does not only allow to cut through the red tape of negotiations, but is also a way to achieve the sustainability of revenues and success of partnerships in the long-term perspective.

Applications

granting a license to the Manufacturing Partners:

In cases where a company entails manufacturing partners in licensing proprietary technology, the valuation is based on the fact that the technology allows the company to improve production efficiency, the quality of the products, or competitive nature in the market. A relief-from-royalty IP valuation approach Singapore is also frequently used and it regulates the industry standards to determine royalty rates to be paid. Analysis should be done keeping in view future economic life of the technology, exclusivity and possibility of future upgrade. The appropriate valuing of the licensed technology also provides fair compensation to the licensor and accounts to the accounting and tax laws and regulations on transfer pricing. Furthermore, a transparent valuation structure will establish trust among partners and avoid disputes in the future concerning the change in royalty or ownership rights.

The Company grants franchises of its brand names and systems:

When it comes to franchise deals, the strength of a brand and the form of operations model given by the system play the cornerstone of the value. Franchisees pay recurring royalty in order to trade using a prefigured name, proprietary systems of business and enjoy the benefits of centralized marketing. The importance of these rights is that it must evaluate the brand recognition, the success rates of the franchise as well as the assistance structures that the franchisor can offer. The Relief-from-Royalty policy is the most widespread one, with modifications of franchise type, development of the sector and competitive positioning. Effective supported valuation assists franchisors to price their royalties at competitive prices, with new partners as well as it is seen to provide substantial value to financial reporting standards like IFRS 15.

Royalty-Based Compensation structure or JV Contributions:

IP valuation is a very important factor in joint venture (JVs) or technology-sharing dealings to establish the equity contribution or profit-sharing terms of each party. The reward systems based on royalty fee make the interests of both parties align, which makes sure that the returns are based on the use of the IP and the performance of the IP. Valuation experts evaluate the estimated revenues of the JVs, cost-saving, and the contribution ratios in order to come up with reasonable compensation frameworks. These arrangements should also be in accordance with IFRS 13 (Fair Value Measurement) and local tax transfer pricing arrangement to be applied for accounting purposes. Thorough valuation will facilitate equitable negotiations and minimize compliance risk as well as improve the level of transparency in governance during joint ventures.

All in all, proper valuation of IP in licensing, franchising or JV structure helps in sound economic relations and regulatory standards. It converts abstract creative into quantifiable defensible business value that leads to extensive growth and confidence of stakeholders.

Conclusion to IP Valuation for Licensing Franchising and Royalty Agreements

Valuation comes to commercialization at licensing. Having an accurate determination of IP value does not only guarantee fair royalty rates, but also reinforced the contractual negotiation and adherence. A justifiably valued system enables the licensors and the licensee to come into the terms of fair compensation that will reflect the actual economic promise of the intellectual property. The process also reduces conflicts, increases transparency in reporting their financial reports and aligns with international accounting and auditing standards like the IFRS 13 and OECD transfer pricing. The quantification of intangible value enables the companies to make better strategic choices whichever choice may be expansion in form of global partnership, the creation of joint ventures as well as the formation of transfer of technology.

Under a knowledge economy, those firms that have learned the art of finding value and commercializing IP create sustainable revenue streams as well as competitive moats that extend beyond physical wealth. The high value practices empower the businesses to discover the untapped value of their intellectual capital, and innovation becomes a predictable financial performance. On top of the revenue generation, efficient IP valuation helps increase investor confidence, supporting funding activities, and long-term brand equity. Eventually, however, it is the potential to commercialize intellectual property based on sound values that distinguish progressive businesses with innovation over businesses who are good at holding ideas but who lack long-lasting enterprise values.