Understanding Intellectual Property Valuation

Understanding Intellectual Property Valuation: A Complete Overview

Guide on Understanding Intellectual Property Valuation: A Complete Overview

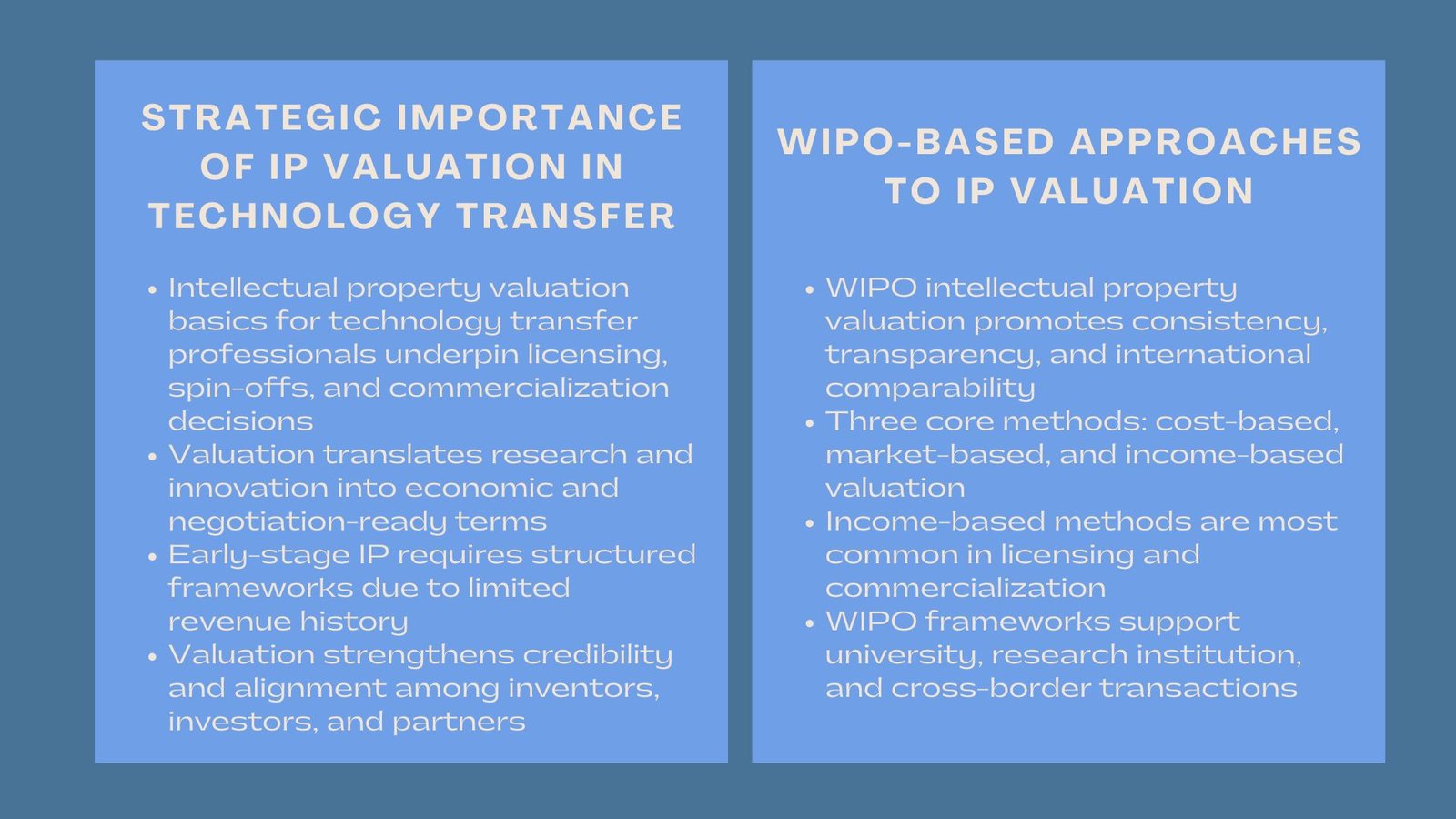

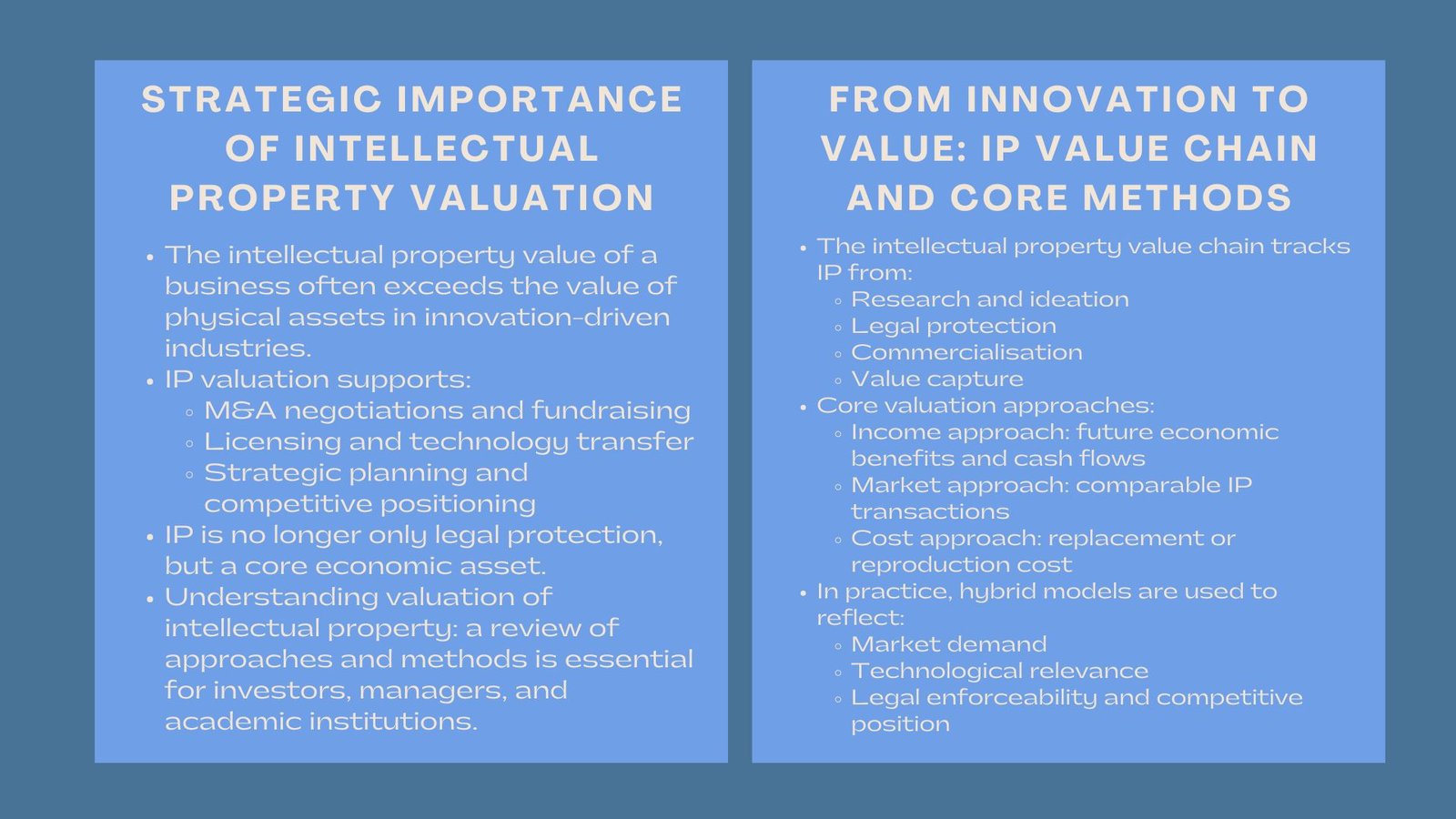

In the current innovation-focused economy, intellectual property (IP) has turned out to be one of the most valuable assets in the balance sheet of a company. Starting with patents and proprietary software up to trademarks and creative designs, IP is the basis of competitive advantage, market leadership, and long-term growth. However, the IP valuation despite its increased importance is a murky and misconstrued subfield of corporate finance. It is not only essential to accurately value these intangible assets to comply and to report, but also to invest, do M&A and make strategic decisions.

Valuation of intellectual property is not just an academic endeavor, but one which directly impacts the business strategy, investor confidence and the results of the transactions. Whether a company is about to enter a merger, raise funds or a lawsuit is eminent, sound valuation offers the financial clarity that all stakeholders require. It is important to examine the principles, methods, and applications that spring forth the IP valuation as per the international standards and the actual practice to understand how this process works.

The Significance of Intelligent Property Valuation.

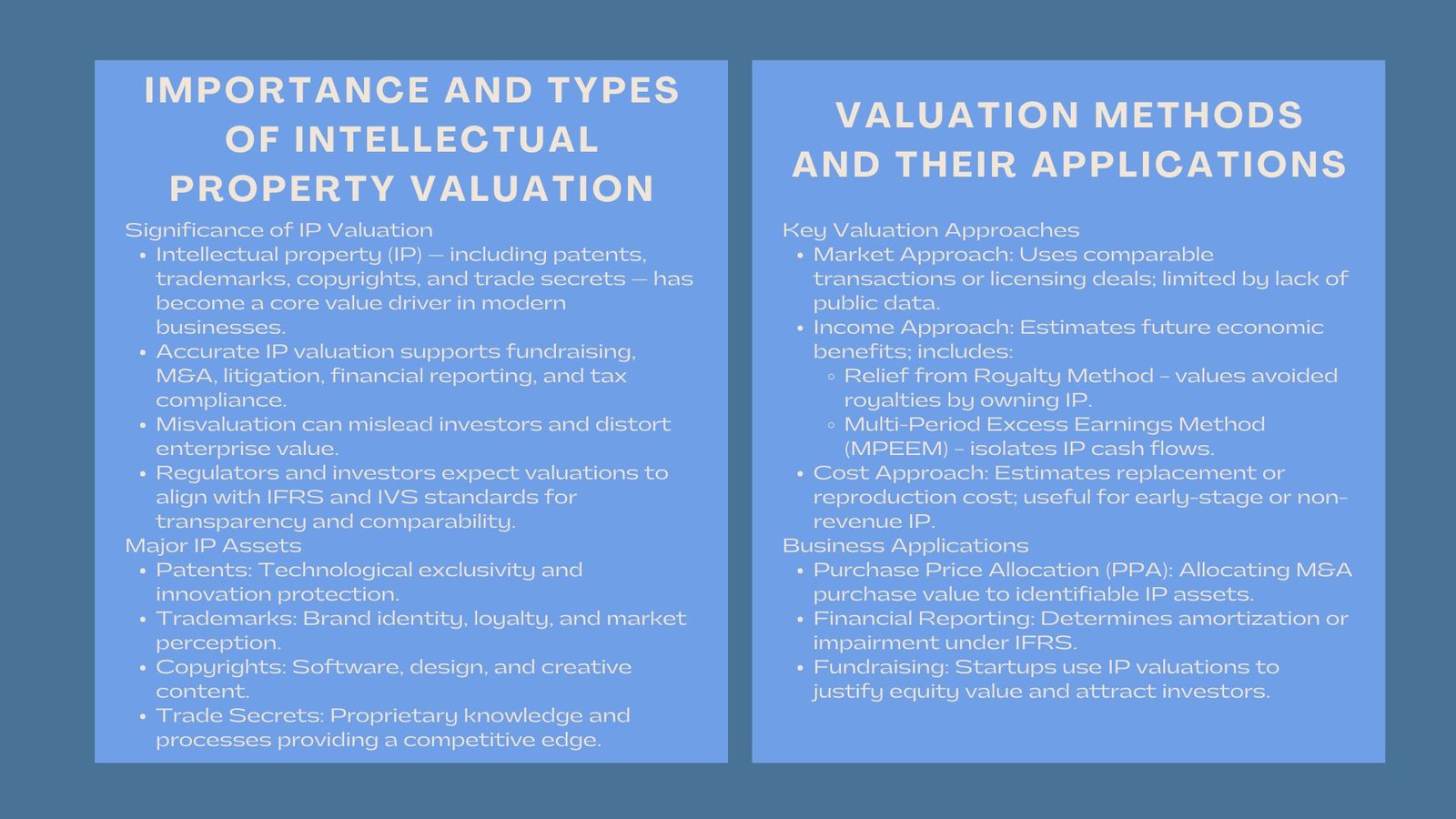

Intellectual property valuation is a critical aspect in the financial reporting and corporate transactions. In the case of start-ups, IP-valuation will facilitate the raising of funds and illustrate the inherent value of the innovations made. In the case of the existing businesses, it provides accounting standards like IFRS to comply with accounting standards and provides transparency in balance sheets and M&A disclosures. Misvaluations are becoming a well-considered issue by investors and analysts who examine the enterprise value and prospective earnings.

In addition, IP valuation helps businesses to achieve improved strategic decisions. The licensing, royalty, and brand acquisitions are heavily relying on the fair value of the IP assets. In litigation or dispute settlement, expert valuation reports are used in order to measure damages and guarantee just compensation. Regulators also demand that IP should be valued according to good economic principles and documented methodologies to be used in tax and transfer pricing purposes.

Major Intellectual Property Property Assets.

It is necessary to identify the key types of IP assets that one may often deal with prior to discussing the methods of valuation. Patents give certain monopoly to the invention or a technological breakthrough, which is sometimes the foundation of an industrial and technology-driven corporation. The trademarks and brand names guard the identity of the company, familiar faces and brand name positioning. Copyrights are applied to creative works like software, design and written materials whereas trade secrets refer to proprietary knowledge, process and equations that give commercial edge.

All these assets need varying valuation arrangements. And to illustrate, the strength of a pharmaceutical patent is based on the remaining life, anticipated market demand and marketability of the patent. On the contrary, the value of a brand depends on the reputation, customer loyalty, and marketing performance. Diversity of IP assets implies that the valuation professionals have to select the most suitable methods and inputs in every case.

Intellectual Property valuation methods.

Three primary valuation methods are in use worldwide to calculate fair value of IP assets and these are the market approach, the income approach and the cost approach. All of them possess their logic, advantages, and shortcomings, based on the type of asset and the access to data.

The market technique values the assets on the basis of similar transactions of similar IP assets. As an illustration, when a trademark in the same industry was recently sold at a specific price, the figure may then be used as a reference. Nevertheless, market information is unavailable and reliable most of the time especially on proprietary or niche intellectual property.

The income method is concerned with future economic benefits of the asset. It estimates cash flows in future which can be associated with the IP and discounts them to the present value with appropriate rate of discount. The most frequently used income-based methods are the Relief from Royalty Method, in which the value is computed as the hypothetical royalties that would otherwise be received by holding the IP as opposed to licensing it, and the Multi-Period Excess Earnings Method (MPEEM), which takes the cash flows of the IP alone.

The cost approach values an asset by determining the amount used to recreate or substitute the asset. It takes into account the cost of development, registration cost, and opportunity cost. This method is normally adopted when there is no assurance of future income or the IP is still in development.

Together, these methodologies form the foundation of intellectual property valuation methods for businesses and investors, guiding analysts and auditors in establishing defensible, compliant fair values for both financial reporting and strategic transactions.

Difficulties with the Intellectual Property Valuing.

The fact that IP is a complicated concept to value since it entails quantitative and qualitative aspects. Most of the IP assets do not have viable markets, and it is therefore hard to come up with fair comparables. The projections of future revenue are based on the assumptions regarding the demand, competition, changing technology, and protecting laws- all which can change very quickly.

Value is also greatly influenced by legal enforceability as well as territorial coverage. A patent that is valid in one place has a high chance of being of little value compared to a globally protected pat. In the same way, the reputation of a brand may vary because of the perceptions of the people in the market, disruption in the market, or even corporate governance.

The other issue is the problem of assigning ownership in case IP is created by more than one subsidiary or by a number of subsidiaries. The compliance with transfer pricing requires that the intra-group IP transactions should be valued at arm length, and therefore professional skills are needed to match the valuation at OECD and IFRS.

IP Valuation in Business Application.

The IP valuation is not the one confined to the accounting or legal compliance but one of the business strategy and decision-making. In the course of mergers and acquisitions e.g. the acquiring company has to allocate the purchase price amongst identifiable tangible and intangible assets, including IP. It is called Purchase Price Allocation (PPA) and is used to figure out a goodwill and influences amortization in future and impairment test.

Financial reporting In financial reporting, under the IFRS, intangible assets that have finite life should be amortized over their useful economic life and those whose life cannot be determined should be subjected to annual impairment testing. Proper valuation will make certain that carrying amounts of IP assets are disclosed by their actual recoverable value which will avoid misstatements to the financial statements.

In the case of startups, IP valuation is an important part of raising. Investors tend to make their equity offers basing on proprietary technology or brand potential. With a reliable third-party valuation, startups will be able to enter into negotiations more favorably and show that they are transparent to their potential supporters, as emphasized in Understanding Intellectual Property Business Value Singapore.

Professional Practice and Standards.

IP valuation has to be performed in accordance with traditional professional standards. The international Valuation Standards (IVS) and IFRS sets offer a fair value determination framework, which is consistent and credible. Experienced valuers use intensive methodology, assume documentation in a transparent manner and justify findings through sensitivity analysis and benchmarking.

There is also the involvement of independent valuers who are essential in ensuring objectivity. Whether engaged for audit support, M&A due diligence, or dispute resolution, these experts bring industry insight and analytical rigor. Firms specializing in professional IP valuation services for patents, trademarks, and brands combine financial expertise with technical and legal understanding, ensuring that the final valuation withstands regulatory and stakeholder scrutiny.

Conclusion

The value of intellectual property is one of the foundations of the modern finance, as it links the gap between the innovation and the economic value. With intangible assets becoming more crucial to the success of businesses, there could never be a more important need to know how to measure them, and how to interpret their value. Through the use of accepted valuation methodologies and use of qualified professionals the companies can see that the intellectual property is not only safeguarded but also well-priced. In the world where knowledge is the new currency, a reliable IP valuation is the key to opening the door to the long-term corporate growth and the trust of the investors.