Understanding the Business Impact of Accurate IP Valuation

Importance of IP Valuation in Modern Business Strategy

Understanding the Business Impact of Accurate IP Valuation

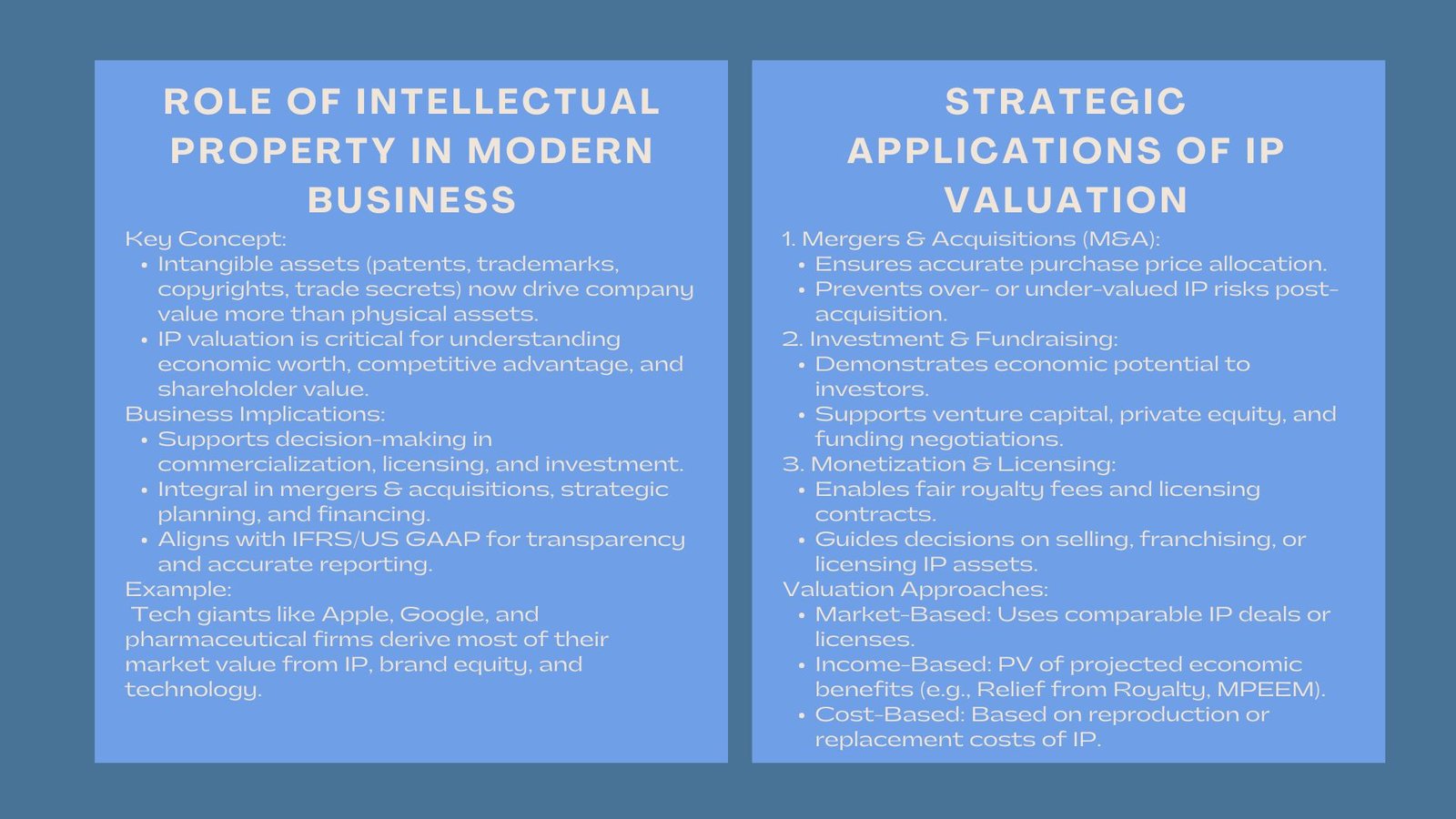

Under the knowledge-based economy, physical assets are frequently outmanoeuvred by the intangible ones in the process of defining the actual value of a company. The intellectual property (IP) such as the patents, trademarks, copyrights, and trade secrets now constitute the core of competitive advantage in any industry. Since the dawn of technology start-ups to the world-renowned conglomerates, identification, protection and valuation of IP assets has become a core component to sustainable growth and shareholder value.

IP valuation is now more than a compliance exercise, and is a strategic management tool. It assists organizations to know the economic worth of their innovation, manage their portfolios optimally, enable them to support mergers and acquisitions (M&A) and to attract investment. Under a more innovation-centered business environment, understanding the value of your IP can have a direct impact on how you conduct your business, your financial statements, and your bargaining leverage.

The role of IP in the Business of the modern times.

The Loosening of Tangible into Intangible Assets.

The old system of business used to create value using the factories, machinery, and inventory. The companies such as Apple, Google, and pharmaceutical giant companies are today earning majority of their value through patents, software and brand equity. These resources bring about customer loyalty, technology and continuous revenue streams. Consequently, IP valuation is essential in capturing an approximate position of a company in the real market.

There is growing pressure on investors and regulators to have the proper disclosure of the value of intangible assets. According to such frameworks as IFRS or US GAAP, the companies need to account the intellectual property obtained as a result of business combinations or development in a proper way. The shift toward intangible-driven valuation demonstrates the strategic importance of intellectual property valuation for businesses seeking transparency and fair representation of their worth.

How IP Supports Business Strategy

Valued IP enhances the decision-making process on various levels. It aids the management in evaluating the innovations to be commercialized, licensed or sold. The valuation of IP achieved through credible IP valuation allows fair negotiation and integration planning in the case of a merger or acquisition. To investors it gives a sense of guarantee of innovativeness of the company and market toughness. Finally, IP valuation enables the gap between innovation and financial performance.

Strategic Admits of Precise IP Valuation.

Improving Mergers and Acquisitions.

During the M&A transactions, the identification and valuation of the IP assets is done to ensure that the buyers know what they are purchasing other than physical properties. Trademarks, proprietary software and patents can be a source of deal structure and purchase price allocation. Over and unrealized IP may result in post-acquisition impairments whereas underestimation may result in the loss of bargaining position. Proper IP valuation can help in the easier integration and correspondence to accounting standards including the IFRS 3.

Sponsoring Investment and Fundraising.

IP often forms a part of the deal-book of startups and high-growth companies seeking venture capital or other forms of private equity to finance their operations. A strong valuation proves the economic potential of the innovations will ensure the investors that innovations can be scaled and defended. Measuring the value of the returns that patents, brands, or technology can generate allows companies to be worth more and negotiate better terms.

Enhancing Monetization and Licensing.

Intellectual property may serve as a significant source of revenue when licensing is used to the businesses having valuable technologies or brands. Having a clear idea of the fair value of IP enables companies to charge relevant licensing fee, negotiate royalty fee, and design long-term contract in a manner that is effective. Valuation is also used in determining whether to license, franchise or sell IP assets on an outright basis.

Significant IP Valuation Methodologies.

Market-Based Approach

This technique values the IP using the similar market dealings with other similar assets. It is best where there is market information or licensing standards, as in the case of better-known trademarks or standard technology licenses. Nevertheless, because of confidentiality and uniqueness of the IP assets, appropriate comparables may not be easy to locate.

Income-Based Approach

The income method uses IP value as an output based on the present value of the future economic benefits that the asset is projected to yield. Such techniques as the Relief from Royalty Method and Multi-Period Excess Earnings Method (MPEEM) are widely employed.These approaches are central to professional IP valuation methods for strategic decision-making, helping businesses estimate realistic revenue streams and cash flow potential from their IP portfolios.

Cost-Based Approach

In the cost-based approach, IP is esteemed as it approximates the level of expense to reproduce or substitute it, taking into account the growth time, effort and the legal registration cost. It is commonly applied in cases where income or market data are either inaccessible such as in early-stage innovation or internal research and development projects. But it might not be a perfect reflection of the potential earnings in the future or the market demand.

IP Valuation as a part of Corporate Strategy.

Fueling Innovation Management.

Proper IP valuation helps to manage the pipelines of innovations. The ability to determine the economic value of new inventions enables companies to focus on the high-cost projects and effectively spend on R&D budgets. This would be beneficial to organizations as it would aid in commercialization of products that have a high impact on long-term profitability.

Valuation is also useful in eliminating under-performing or non-core IP resources and deploying resources to more valuable opportunities. Established IP management based on trusted appraisal information enables enterprises to remain lithe and competitive in fiercely competitive markets.

Enhancing Financial Reporting and Governance.

As the investors and regulators demand greater transparency, IP valuation transparency increases credibility of financial reporting. Proper valuation helps in conformity to the IFRS principles of intangible assets, impairment testing and business combinations. It is also useful in enabling the management to spread the value of innovation at the company to the shareholders enhancing investor confidence and corporate governance.

Tax Planning and Supporting International Expansion.

Due to the globalization of businesses, the value of IP is very important in transfer pricing, cross-border licensing as well as tax optimization. Effective valuation means that tax rules, which are International, are adhered to, as well as the risk of conflicts with the government is reduced. It also allows the firms to strategically assign intellectual property rights in various jurisdictions to maximize tax costs.

Prospects in IP Valuation.

Models of Valuation formed by technology.

The IP valuation practices are changing with the development of data analytics and AI. Patent citation, competitive environment, and market requirements can be also analyzed by automated models to provide estimates of asset value in a more accurate way. These are used to assist companies in real time tracking of IP performance and make quicker data based decisions.

Increasing Significance of ESG and Corporate Reputation.

Environmental, social, and governance (ESG) goals are slowly coming into contact with intellectual property. The innovations should be valued by the companies that invest in sustainable technologies, green patents, or socially responsible brands. With the onset of ESG reporting, IP valuation will become more significant in showing the contribution of a company to the long-term impact on the society and environment.

Conclusion

In the new economy, intellectual property is much more than a legal protection, a strategic asset, which determines the competitive advantage of a company and its potential to be developed in future. Properly and substantially established IP pricing enables enterprises to make wise choices in investment, M&A, licensing and international growth. Since intangible assets are increasingly becoming the driving force behind market capitalization in any global market, learning how to value IP will be an important component of corporate strategy. Those companies that incorporate sound IP valuation principles into their decision making cycles will be in a better position to be able to innovate, compete and prosper in the knowledge economy.