Understanding the Challenges and Limitations of IP Valuation

Guide on Understanding the Challenges and Limitations of IP Valuation

In the modern digital and innovation-driven business environment, intellectual property (IP)- patents, software, brands, trade secrets and customer data tend to be a significant part of company value. Nevertheless, one of the most complex and multifaceted branches of corporate finance is its valuation of such intangible assets.

Whether it is a startup with new technology that needs to be introduced, or an established company handling legacy brands, it is necessary to be aware of what the traps and limitations of IP valuation are to each executive, investor, and an advisor. Accessing professional patent valuation services in Singapore, leveraging IP valuation services in Singapore, and engaging Singapore intellectual property valuation services can help businesses navigate these challenges with accuracy and compliance.

Why the Accuracy of IP Valuation Matters

Negative impacts of not qualifying IP valuation go way beyond figures in a report. The acquisition firms use valuations to inform the purchase price allocation as well as to arrive at goodwill in mergers and acquisition. During negotiations of licensing or joint venture, valuations are used to determine royalty and revenue sharing arrangements. Legal damages also depend on believable value estimates, e.g. in litigation over infringement.

In addition, in enterprises that require startup or scale‑stage funding the valuation company of IP has the potential to define the perception of investors, capital generation, and bargaining power. The stakes are high in the event of bad valuation, i.e., paying too much to physical assets, mispricing of strategic transactions, incorrect advising of the company stakeholders or even a company being subjected to regulatory or an audit report.

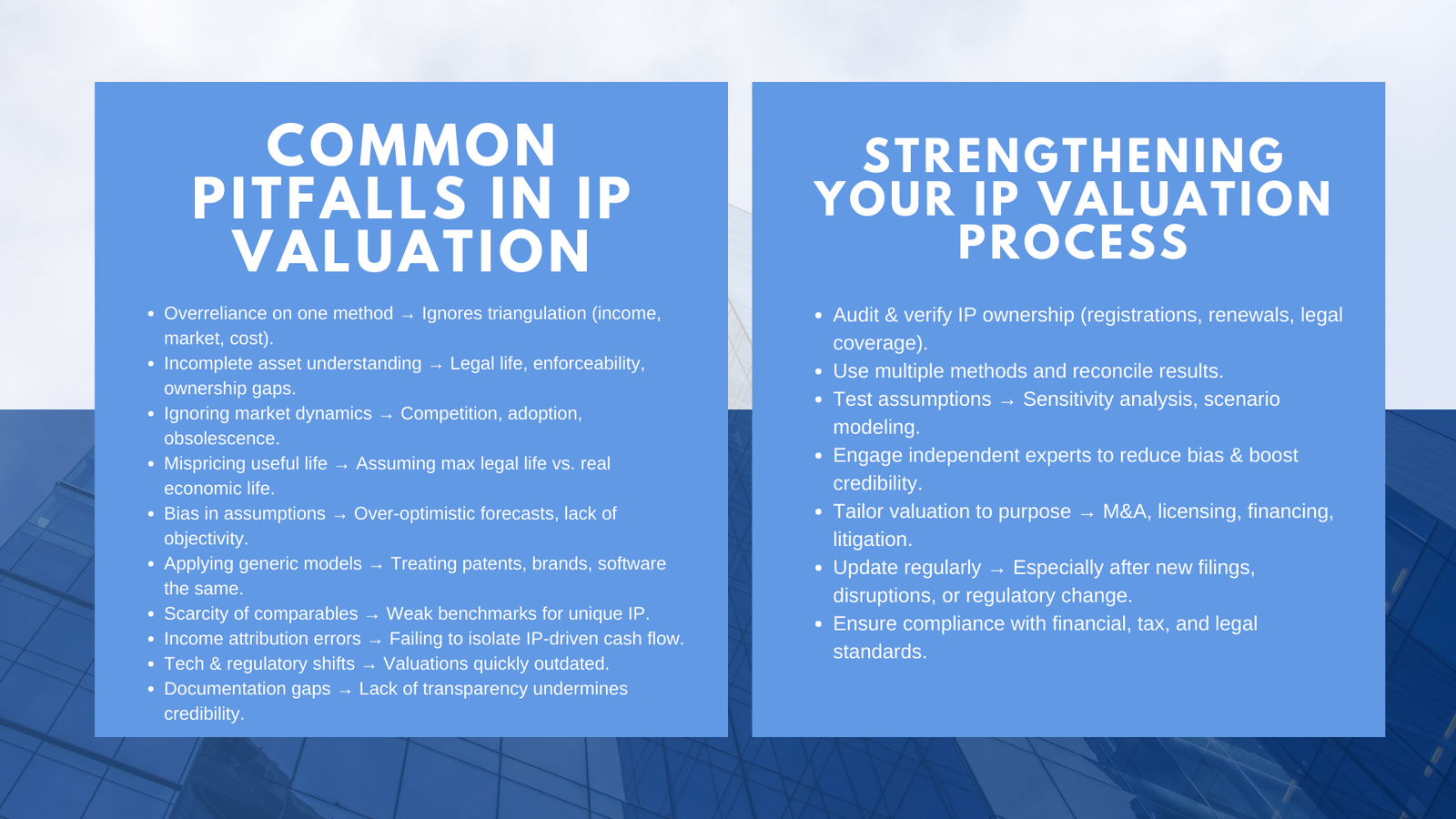

Overreliance on a Single Valuation Method

A common IP valuation mistake is reliance on a single method e.g. the present value of future income without seeking triangulation of the value using other methodologies. In cases where the uncritical dominance of income-based models is applied, assumptions within it can significantly distort the conclusion made in relation to revenue growth, discount rates or products lifecycle. Correspondingly, the limitation of cost‐based valuation (what it cost to build the asset) marginalizes income potential whereas the market based valuation fails when there are no similar transactions. When conducting the valuation well it is expected that the income, market and cost approach should be incorporated in the final valuation and reconciliation done to arrive at a mid point resultant estimate.

Incomplete Understanding of the IP Asset

The valuation process can follow with little appreciation of the IP in terms of its own legal life, its enforceability and routes of upgrade and its relevance in the market. The valuers can miss out on making vital calculations of patent expiry, existing geographical coverage or the risk of being pushed out of the industry by a technological upheaval. Also, when ownership, licensing rights, or enforceability under local law are not adequately verified, less confidence is given to the valuation. Unless one fully understands these legal and functional aspects, estimations will over-price on IP that is doubtful or supportable.

Neglecting Commercial and Market Dynamics

Intellectual property is not in a vacuum. It is really worth only as it manages to behave in the real world market adoption, competitive threats, demand elasticity and regulatory trends. However, other valuations completely disregard these dynamics and instead place the focus on a non-dynamics model. As an illustration, a patent that shows only potential income on the theoretical scale can be eclipsed by the newer competing technology being introduced into the market. Old stores with historical values can fade quickly in new tastes. When only using the valuation model, most of the time, the result becomes over‐optimistic as the outcomes fail to reflect a realistic and competitive environment.

Mispricing Useful Life and Obsolescence

Any valuation of an IP asset is a speculative estimate concerning the economic useful life of the asset. Although it is possible to defend oneself with the help of the legal forces during 20 years, the property can lose its value far earlier. Analysts almost always resort to maximum legal lives or random period dates without taking in consideration market discontinuity and product cycles. It is possible to undervalue the alternatives or overestimate the revenue-generating potential of the assets. A strong valuation should take into consideration a realistic projection timeframe that is based on internal R&D roadmaps, competitor analysis and industry trends.

Bias and Lack of Objectivity in Assumptions

Valuation assumptions are usually bred with bias in internal forecasts, management interviews, or even subjective optimism. Credibility is compromised by either overestimating IP IP revenue, underestimating discount rates or anchoring on preceding valuations. Such valuations can possibly seem manufactured to achieve a predetermined business result absent the transparency and/or even certification thereof. Use of external professionals, consideration of assumptions and the use of sensitivity analysis are some of the ways of eliminating bias and developing defensive valuation outcomes.

Applying Generic Models Across Diverse IP Types

All the IP assets should not be valued in the same manner. Each of the forms of value is represented in Patents, brand equity, software and trade secrets. But valuation models tend to address all intangibles as a homogeneous set, disregarding the fact that economic advantage varies across classes of assets. The value of a trademark can be termed as brand loyalty and perception of name as being in the market whereas the value of a patent would be its ability to enforce and license. It is important to identify and adjust to such differences in order to come up with subtle valuations that are accurate.

Scarcity of Reliable Market Comparables

In the case of unusual or special IP, there are few or no comparative sales, and therefore it becomes hard to use the market method. In the industries in which IP licenses or trades are not uncommon, a lack of comparability is imposed by confidentiality and deal-specific terms. The approach consisting in hypothetical royalty rates without benchmarking may be the one that is unconvincing. Such valuations must also modulate the assumptions on income or they should put proximate transactions and clearly explain the restrictions and band of uncertainty.

Underestimating the Challenge of Isolating Income

It may be hard to distinguish what portion of the value is due entirely to IP, often as this is bundled into a larger product or service. Revenues can denote the sum of network effect, human capital, brand, and IP. The cash flow that could be directly linked to IP, as opposed to the general business performance, has to be identified via scenario analysis. Failure to budget the income appropriately poses a danger of overstating the standalone IP.

Rapid Technological or Regulatory Change

Valuations of IP in blistering industries like biotech, AI, or fintech can become outdated almost immediately after they are done. Market conditions change, new entrants come into the market, or a ruling in a court of law alters enforceability. Unless valuations done at least once a year, or when an event of disruption happens, they become irrelevant. Valuation procedures featuring gauges of periodic reviews and re-assessment on some determinant triggers or corporate milestones or subject to regulatory changes are opportune.

Documentation Gaps and Lack of Transparency

Trust is undermined by opaque valuation reports, i.e. reports which do not provide detail in terms of assumptions, methodologies and sensitivity analysis. Valuation logic can be interrogated by stakeholders who have an economic interest in the valuation such as investors, auditors, or tax authorities particularly in cases where the IP value constitutes high percentages of the enterprise value. Failure to scope significant inputs, rationale of the model nor constraints can diminish the value of the valuation assessment and consequently risk re-statement or challenge.

Integrating Legal, Tax, and Financial Compliance

The valuation of IP can be subject to different standards (by jurisdiction, or by purpose). As an example, financial reporting valuations will need to comply with IFRS or FRS 109 regimes; tax valuations may necessitate other depreciation or amortisation treatments; legal valuations used in damages claims may need to adhere to published case law. Lack of these multi disciplinary requirements in a model may be non-compliant or lead to a tax exposure or legal vulnerability.

How to Strengthen Your IP Valuation Process

Sensible IP valuation demands complex enhancements. Companies are advised to initiate an IP-audit process by getting their ownership verified, recording legal coverage and enforcing records. Appraisal ought to use two or more complimentary methods, and the consistency of the method has to be ensured. Assumptions should be properly documented, tested under sensitivity conditions and updated with time. The use of independent experts will introduce rigor into the process and eliminate bias. The last in this line of recommendations is that to increase relevance and defensibility, it is preferred that valuation methodology should be matched to the particular use case i.e. M&A, licensing, financing, or litigation.

Conclusion: Understanding the Challenges and Limitations of IP Valuation

The valuation of intellectual property is an essential exercise in contemporary business planning although it proves to be a complicated and inaccurate process. Misjudging familiar traps of subpar methodology, poor documentation, bias and incomplete market context can result in half baked valuation, flawed decision making and poor decisions. The inherent limitations of IP valuation models can be addressed with disciplined modeling, cross-validation, frequent update and publicity. To unlock a sustainable and defensible corporate advantage will require businesses and investors to realize these pitfalls and proactively address them in an effort to develop sustainable and defensible corporate IP advantage.