Why Valuing Intellectual Property Matters for Business Value

Learn Why Valuing Intellectual Property Matters for Business Value

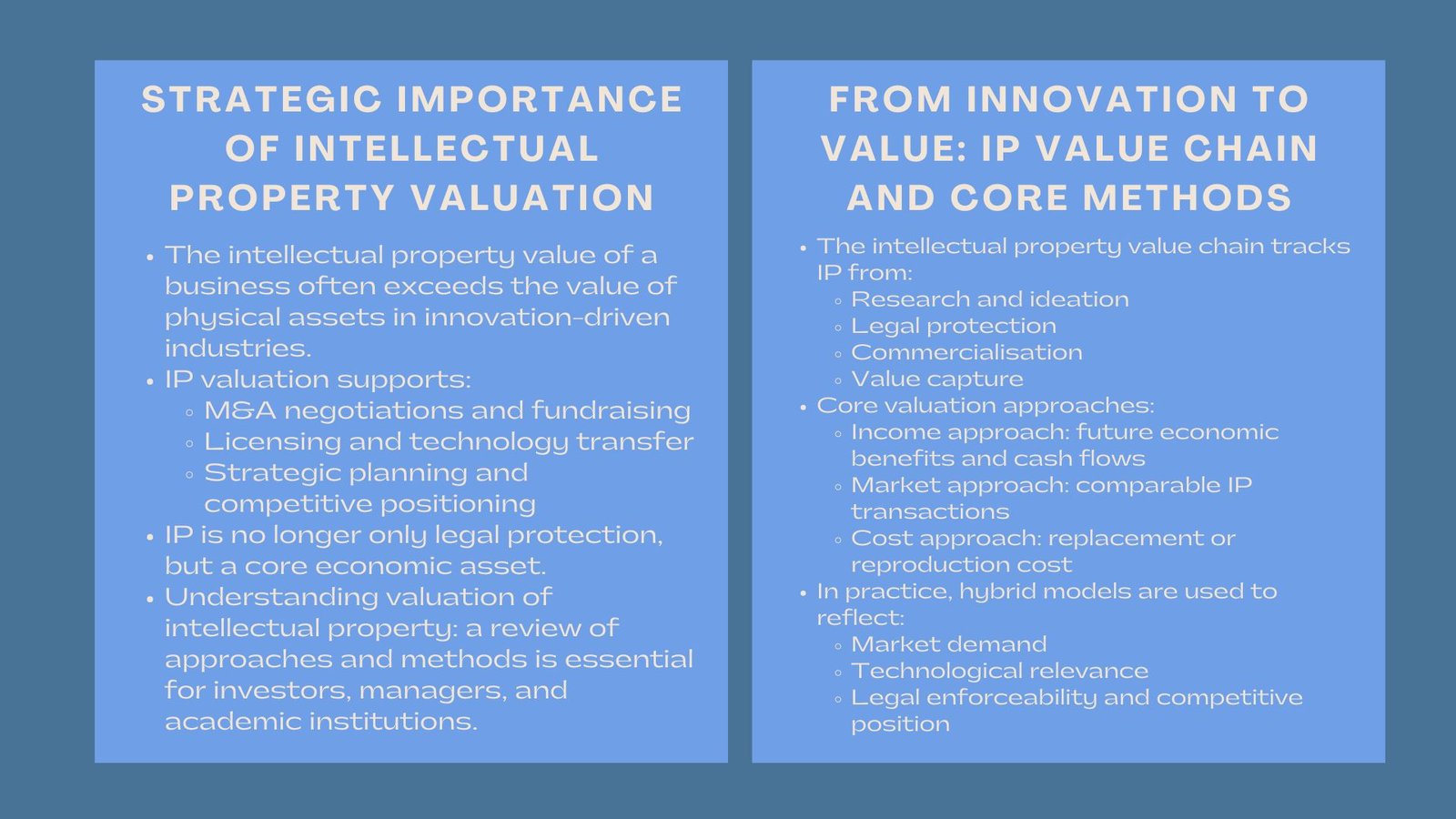

Intellectual property (IP) has now become one of the most important business value drivers in a modern knowledge economy and data- and creativity-driven economy. Particular to numerous businesses, including tech firms, pharmaceutical, entertainment, and consumer brands, IP is found to be a major part of their corporate value. However, intellectual property is not always recognized enough or appreciated and in some cases it might be misinterpreted or even ignored when it comes to strategic decision-making. This is why understanding the key points for patent valuation in Singapore becomes increasingly important for businesses seeking to capture their real worth.

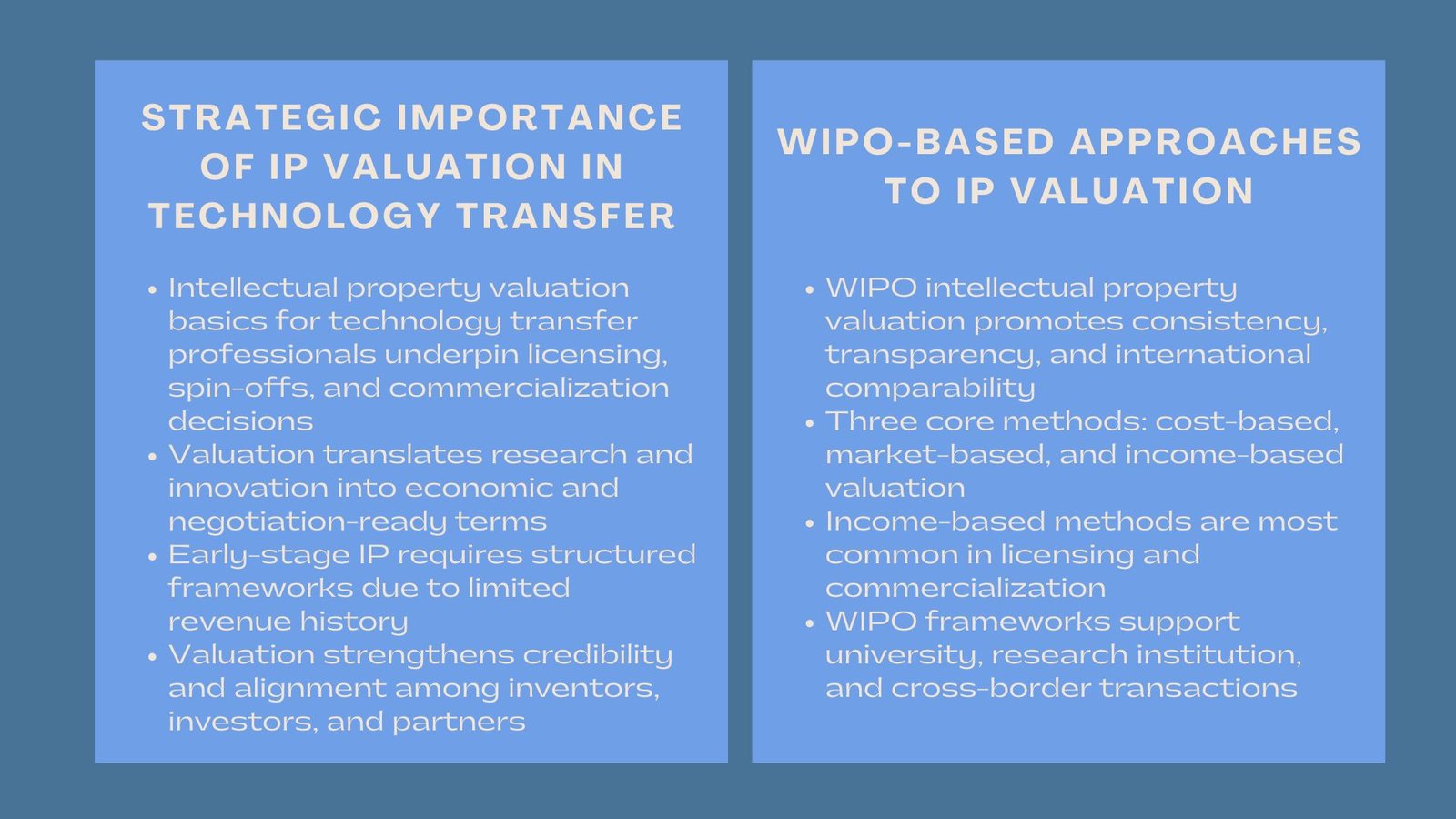

The appreciation of intellectual property goes further than just a financial reporting requirement because it is a strategic activity with implications on investment strategy, mergers and acquisitions, financing, and competitive advantage. A business that does not have a good gauge on the patent and intellectual property valuation Singapore experts provide may be selling itself so cheap when making deals, they may be overspending when acquiring another firm, or leave on the table opportunities to use these assets to grow. By relying on professional patent valuation services Singapore, companies can ensure that their IP is accurately assessed and leveraged as a strategic asset.

The Strategic Role of Intellectual Property

Intellectual property is a composition of the mind that includes patents, trademarks, copyrights, trade secrets, and proprietary designs that grant an edge of competition to businesses. It is also safeguarded by the law allowing companies to manipulate its usage, monetize on it, and stop the misuse of the same.

For example:

- Patents safeguard new inventions and methods of doing things and as such, businesses can take advantage of the innovation.

- Trademarks protect the brand name, which allows recognition and loyalty of the buyer.

- Examples of work that is subject to copyright include books, music, movies, and code.

- Trade secrets protect proprietary data that provides an edge over the competition such as a formula or list of customers.

With an appropriate management in place, IP can bring in streams of revenue in terms of product sales, licensing and partnerships. It may also be used to secure loans, to encourage investment and to aid the expansion into different markets. This is why IP valuation becomes a critical consideration not only in legal terms, but also in terms of strategic business planning.

Why IP Valuation Is Critical for Business Transactions

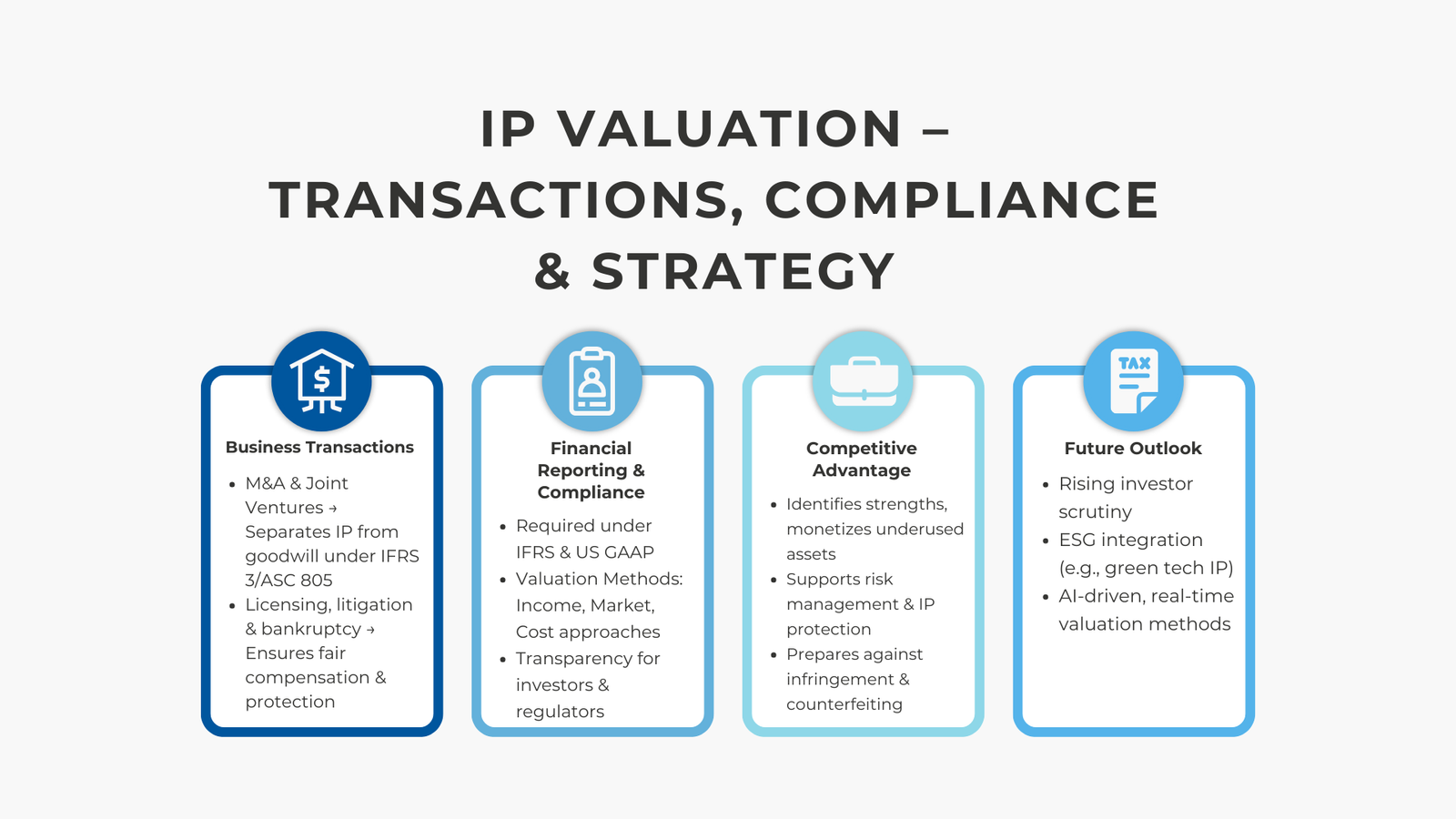

IP usually represents a significant value of the transaction in corporate acquisitions (joint ventures, mergers and acquisitions). You see, buyers and investors must know the fair market value of these assets to be able to make their decision and negotiate sufficiently.

In a purchase price allocation (PPA) under IFRS 3 or ASC 805, the IP value has to be recognized and reported separately to goodwill. This is to make it transparent and have a clearer view of the economic motivation behind the acquisition. The failure to describe the IP cannot adequately also change the financial reports, mislead the interested parties and create certain accounting difficulties in future, such as unexpectedly high impairment costs.

In parallel to M&A, IP valuation is needed in:

- Licensing IP: in this situation, proper valuation would result in equitable payment to exercise the IP.

- Time consuming litigation and disagreements, damages could be quantified in terms of the economic worth of the obstructed IP.

- Bankruptcy processes as in cases where the IP assets can be auctioned off in order to repay the creditors.

Whether it is acquisitions or setting the price of IP in the market, an objective and well documented IP valuation is beneficial to any particular company in guarding its financial interests.

Financial Reporting and Regulatory Compliance

With regard to the financial reporting perspective, the valuation of intellectual property is needed to comply with the accounting standards and regulations. Under IFRS and US GAAP, a company will be required to measure at fair value intangible assets identified as acquired in a business combination on the acquisition measurement date.

This involves expert skills in coming up with what is known as the present value of future economic benefits of the IP. The common valuation techniques are

- Income Approach – The most frequently used forecasts future cash flows related to the IP and discounts the cash flows to present value.

- Market Approach – Using the IP to compare to other assets in the market that have sold or been licensed.

- Cost Approach – a listing of the cost of re-development or replacement of the IP to porches.

In addition to the compliance, proper valuation of IP enables management to monitor the value of intangibles over time, more informed investment choices and determines whether IP is still aiding the planned long-term approach of the company.

Competitive Advantage and Strategic Decision-Making

The intellectual property that a company holds is not merely a body of intellectual property protection, but a body of intellectual property assets that can determine the basis of competitive positioning. Companies that routinely evaluate the worth of their IP are in a better position to find out their areas of strengths and weaknesses as well as opportunities that they may use to make money out of them.

An example of where a company might resort to IP valuation is when a business with great patents in new technologies seeks a strategic partner or sources of capital to enable the development of a new product. A strong brand with much recognition and loyalty can use valuation knowledge to either claim hefty prices or even penetrate the near markets.

In addition, with the help of IP valuation, underutilized assets may be identified, which can be licensed, franchised, or otherwise monetized. There are situations when a company will note that the intellectual property it has is more valuable than their tangible assets and this has led to transformation of the business strategy to concentrate on the intangible driven growth.

Risk Management and IP Protection

Knowledge of the worth of intellectual property is also critical in dealing with risk management. Having the knowledge of the value of their IP also means companies will be more prepared to respond to infringement, theft and dilution.

In highly competitive and innovative industries, IP is likely to be a victim of the competition or counterfeiters. Valuation can assist with prioritizing the property that needs the greatest protection and the justified cost of taking enforcement measures. It can also be used to make decisions concerning insurance cover of all the intangible assets so as to help reduce possible losses incurred.

Also, a third-party supported valuation will be helpful in an IP damages claim. Courts and arbitration tribunals frequently use the expert valuation to decide on damages or settlement figures.

The Future of IP Valuation in a Knowledge Economy

With an increasingly digital and innovation-driven global economy setting in, it is likely that the representation of the corporate value that is embodied in intellectual property is only going to increase. There are a number of implications of this trend

- Greater scrutiny from investors – The investors, both shareholders and analysts, will demand more transparency on the nature, value and performance of the IP assets.

- Integration with ESG reporting – ESG reporting Another area of alignment will be environmental, social, and governance (ESG) elements, which will see IP, where used in jurisdictions or products like that of green technology, get aligned with sustainability reporting.

- Evolving valuation methodologies – New methods of data analysis, Artificial Intelligence and market metrics will make IP valuation more accurate and in real time.

Companies who have aligned themselves with these trends by routinely valuing and managing their IP portfolios are becoming better places to compete, innovate and attract capital in the coming years.

Conclusion: Why Valuing Intellectual Property Matters for Business Value

The concept of valuing intellectual property is not an accounting exercise; it is a business strategy. IP valuation influences M&A negotiations, sources of finance, financing risk management, competitive advantage, and can create choices that affect the future of a company.

With the recognition of value to their intellectual property, companies will have the capacity in their strategic decision-making, realization of hidden value, and the recognition, protection and exploitation to the fullest potential of their most valuable resources. In an increasingly world where intangible assets are becoming the new definition of corporate success, IP valuation will no longer be an option, it will be a must.